As a continuation from our previous blog Fibonacci Trading Tactics Part 1, we will be looking at 50% retracements. Although 50% is not a true Fibonacci sequence number, 50% retracements have proven useful to traders. Below you will see the Fibonacci tool used with DAS Trader Pro.

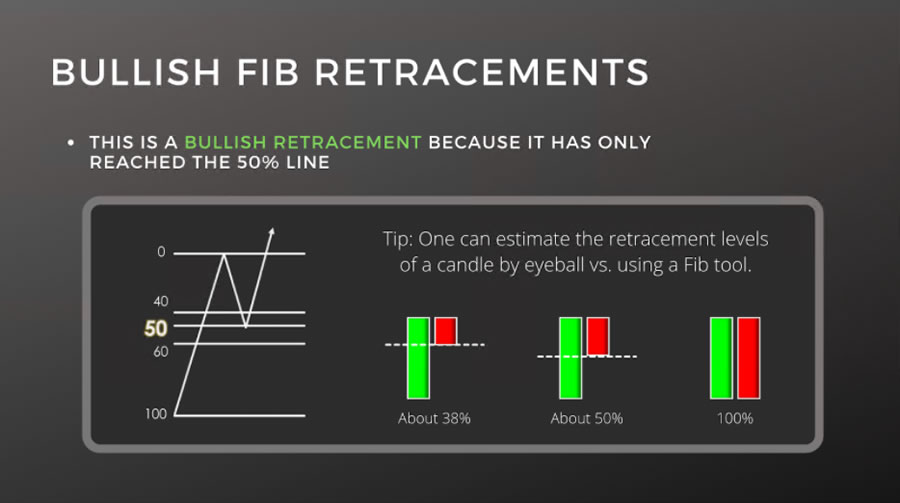

Very often, what we think is 50% might be greater or less than it actually is. Part of our job as traders is to measure the retracement and put the lines on our charts. Over time you’ll begin to be able to accurately monitor the charts. Remember that it’s always good to train yourself to read the charts in candlesticks using bar by bar analysis.

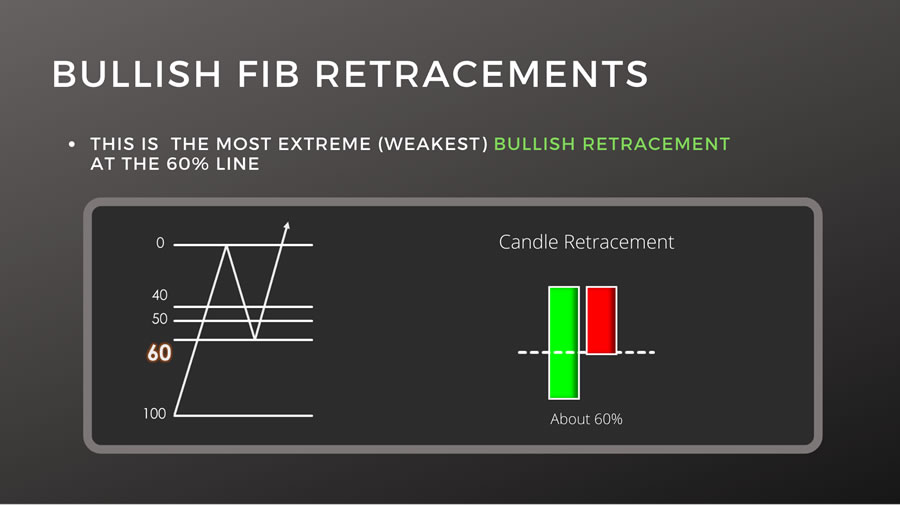

The deepest retracement level is 60%. Anything more than 60% is considered a Bearish retracement. Once you get past 60% you no longer expect the stocks to make a new high. It will use up too much of its potential energy getting back up to the prior high that the resistance may now be too great for it to break out to a new high on a single try.

As seen below, a pullback that ends at the 60% retracement line should be able to make a shallow new high, but anything more than this will most likely falter once it hits the prior resistance level.

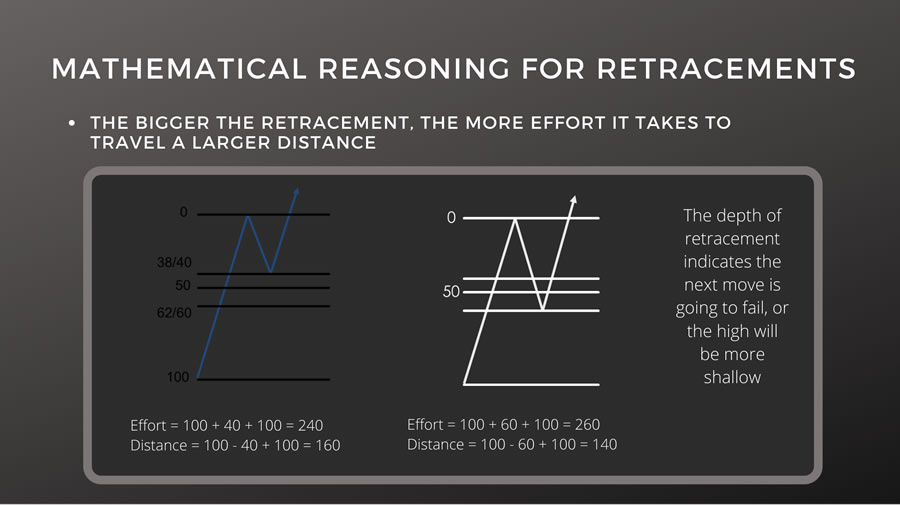

The Mathematical Perspective: Below is a comparison between a 40% and 60% Fibonacci retracement. The 40% retracement shows that the stock moves up 100 points on the initial move, pulls back 40 points, and then makes a move up an additional 100 points; giving a total distance traveled of 160 points in one direction. 240 points in effort equals a 160 point move up in value. The 60% retracement shows that that stock moves up100 points, moves back 60 points, and then moves up an additional hundred points. In this example, the stock has to move a total of 260 points to advance only 140 points up. This shows that mathematically it takes more buying effort to make a smaller move in direction/distance up on the chart.

The Mathematical Perspective: Below is a comparison between a 40% and 60% Fibonacci retracement. The 40% retracement shows that the stock moves up 100 points on the initial move, pulls back 40 points, and then makes a move up an additional 100 points; giving a total distance traveled of 160 points in one direction. 240 points in effort equals a 160 point move up in value. The 60% retracement shows that that stock moves up100 points, moves back 60 points, and then moves up an additional hundred points. In this example, the stock has to move a total of 260 points to advance only 140 points up. This shows that mathematically it takes more buying effort to make a smaller move in direction/distance up on the chart.

In our next blog, we will visit bearish retracements and other Fibonacci tactics such as fib extensions. Trade Well!

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More