As 2023 comes to a close, let’s do a year-in-review for 2023. We will then focus on what to expect in 2024.

2023 – A Year for the Bulls

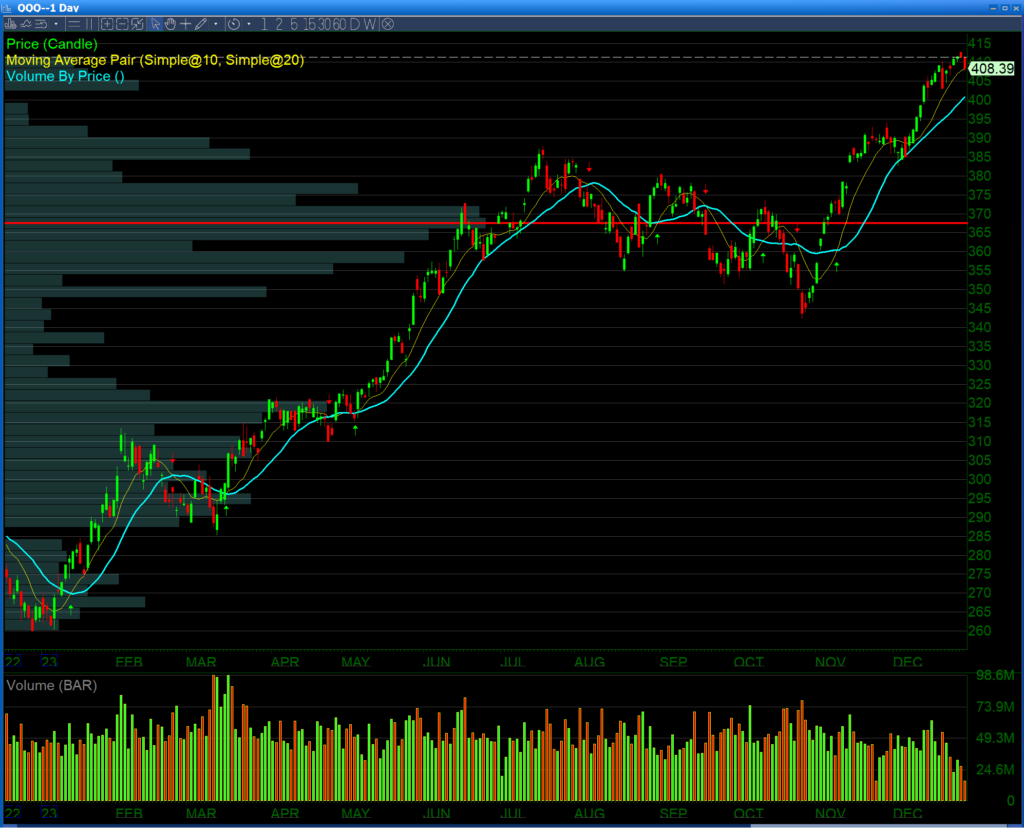

First things first, the Federal Open Market Committee (FOMC) gave the market an early Christmas bonus in December 2023. It decided to hold the federal funds rate steady for the third consecutive month, at a range of 5.25% to 5.5%. Moreover, it signaled that it expects to cut the rate three times in 2024, down from its previous projection of one hike. However, it also left the door open for future rate increases if inflation returns. The FOMC stated that it “will continue to assess the appropriate path of the federal funds rate over time, taking into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments” (learn more). This somewhat mixed messaging gave the market what it had been looking for. According to the CME FedWatch Tool, the market had priced in a 100% probability of at least one rate cut by May 2024, and a 50% probability of three rate cuts by December 2024. Therefore, the market reacted positively to the FOMC announcement, and surged to new highs. Undoubtedly, 2023 was an incredibly bullish year for the Nasdaq 100 tech index, which led the rally with a 21.2% gain for the year, as seen by the chart below of the Invesco QQQ Trust (QQQ).

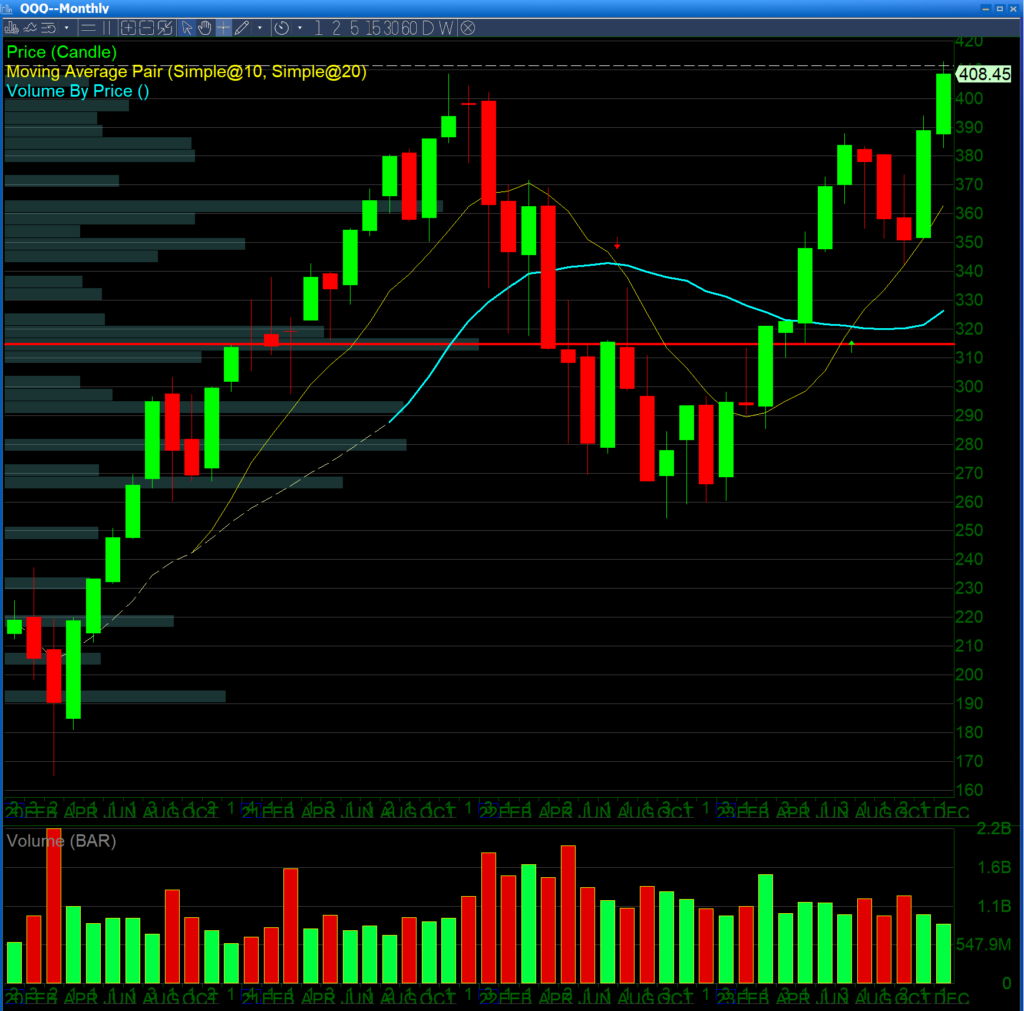

Let’s put this into context; 2022 was an incredibly bearish year. So 2023 wiped out all of the bearishness of 2022 and made small year-over-year gains from the 2021 highs to the 2023 recent new highs. Looking at things from a much longer term perspective, this creates a double top with a slightly higher high, as evidenced in the chart below.

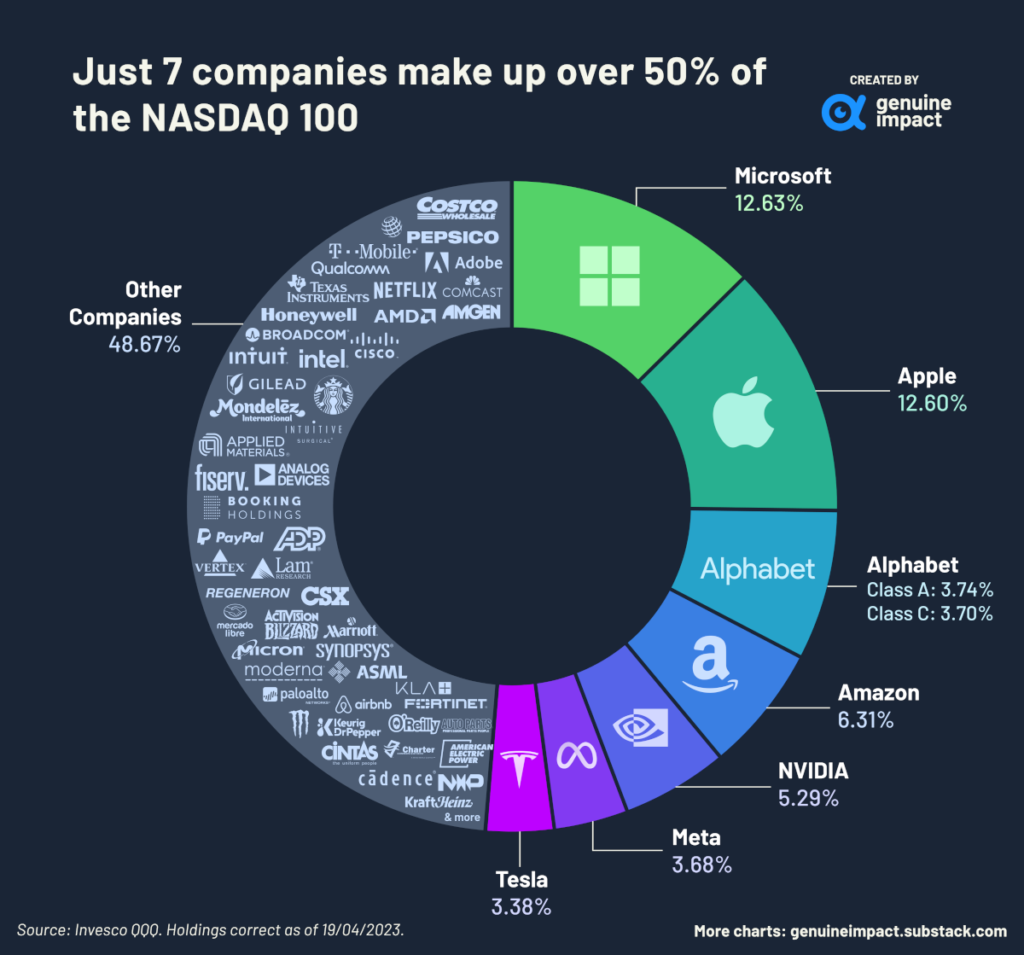

There is one more factor to consider: the indices have become very concentrated. What this means is that the seven biggest companies of the technology sector make up over 30% of the NASDAQ. After tremendous gains in 2023, the law of percentages makes it difficult for these kinds of percentage gains to mathematically continue. The seven biggest companies that comprise the Nasdaq are: Apple ($AAPL), Microsoft ($MSFT), Meta ($META), Google ($GOOG), Amazon ($AMZN), Nvidia ($NVDA), and Tesla ($TSLA) have now have double digit growth, which will be hard to follow up in 2024 regardless of what the Federal Reserve does or does not do.

Will the Gains of 2023 Continue?

2024 is an election year; historically election years are more volatile. Add to that the reality of unrealistic expectations of continued earnings growth, as well as the major market indices being concentrated in the aforementioned seven big tech names. We should not expect the kind of gains that we had in 2023 to continue. In fact, from a technical perspective the most healthy thing the market could do is go sideways to correct through time and consolidate gains. If the market does pull back, then the October low of 2023 would be the first level of support, with the lows of 2022 as the next level of support down.

Looking Ahead to 2024

From a technical perspective, the market is showing signs of a double top with a shallow new high, as shown below on the weekly $SPY chart, which is the broader market index.

From a fundamental perspective, it will be difficult for earnings growth to continue at the current pace. In fact, there are many potential issues on the Wall of Worry and any one of these many potential factors could trigger more market volatility.

The Wall of Worry in 2024

First, there is a pending U.S. presidential election which we have already mentioned. Additionally, it will be more contested (to put it mildly) than unusual (from a historical perspective) than ever before.

Next, inflation could potentially return at any time, causing the Fed to raise rates instead of what is now expected to be a year of cuts, even though the Fed has continually messaged that it might not be done raising rates. The market has only heard half of this message, namely, the side that it wanted to hear. Markets are always forward looking so this optimism is to be expected.

Finally, the big seven technology companies that have led the market gains just mathematically cannot continue to sustain their financial numbers. The unusual circumstances of the pandemic combined with the AI technology rally continues to make 2023 an incredible year for the big seven tech companies.

An Exceptional 2023 with an Uncertain 2024

2023 turned out to be an exceptional year in the market, as it recovered all of 2022’s losses, but it is also setting up 2024 to be a turbulent one. A year where there is the potential for a lot of volatility, and in the best case, small gains or small losses, which would be considered a consolidation of the exceptional gains that occurred during the post pandemic rally and into 2023. The prudent trader or investor should set their expectations accordingly. Be prepared for 2024 to be volatile in the worst case or boring in the best case. If there are signs of increased volatility, then be ready to take precautions. In summary, valuations are high, and technically, we have a double top with a shallow new high. Have a happy new year!

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More