Are we seeing the fall of big tech or is this just a bump in the road? April, which is traditionally and statistically a bullish month (IRA contributions usually drive up markets before tax day), turned out to be the most bearish month that we’ve had in the U.S. stock markets since March of 2020. A combination of factors have ravaged the markets.

- Rising inflation is the largest problem that cut into companies’ earnings last quarter. A related problem is rising interest rates which needed to be raised long ago, but due to the pandemic and other geopolitical problems, they were not raised quickly enough to keep inflation in check.

- Overstimulus is the root cause of the inflation problem; not just monetary policy but also fiscal policy. The government printed too much money from nothing, while the Federal Reserve bank purchased too many assets in the open market. This stimulated the economy domestically and internationally. It also pushed stock markets higher while creating an asset bubble.

- The war in Ukraine became the final factor to devastate the markets. It further delayed the Fed from aggressively raising rates for an extra 2 – 3 months and drove up key commodity prices. This exacerbated the supply problem while the over stimulus exacerbated a demand problem.

The Fall of Big Tech

$NFLX earnings tells it all; After 2 years of tremendous growth, Netflix lost users for the first time ever. For streaming companies like Netflix, the pandemic and lockdowns could not be better, but that growth would have to come to an end sometime. Netflix lost users in every market except the Asia pacific region where the pandemic lockdowns still linger.

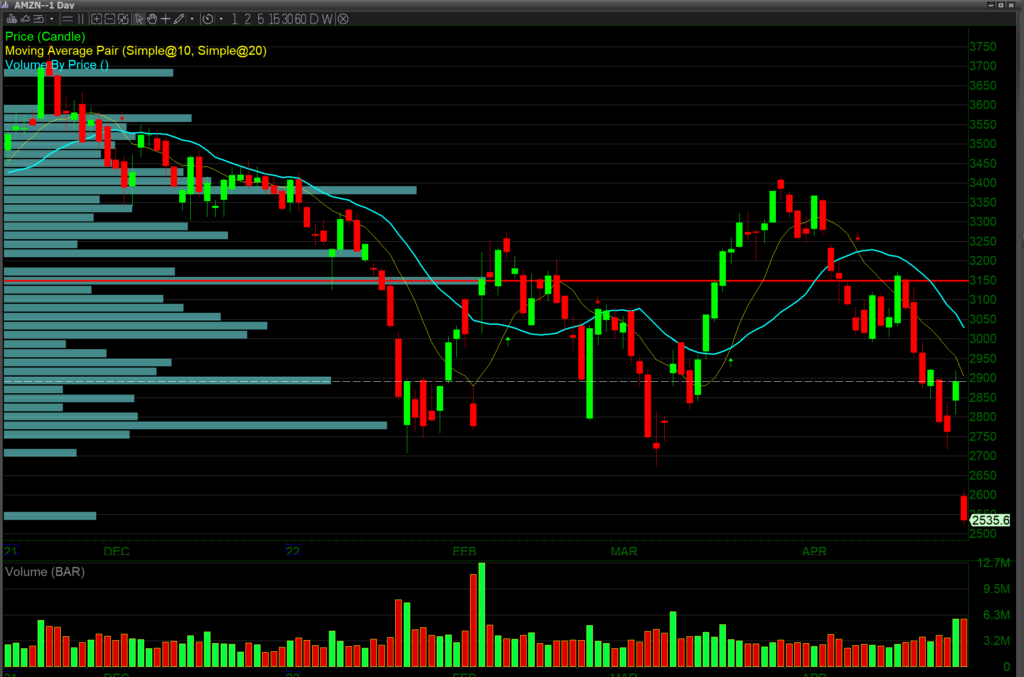

Amazon ($AMZN) faces a similar challenge; it is mainly an online retailer with thin margins. It also has supermarkets and delivery infrastructure which as costs increase due to inflation, those thin profit margins disappear. Recent unionization efforts further drive up prices.

This is known as tech saturation. Many factors that lead to massive growth have now reached the saturation point. Five years of digital growth occurred in the last two years of pandemic related problems

Where do we go from here?

What will happen in the markets and in the economy and how do we profit from it and not fall victim to it?

Whether our economy falls into a recession or not, it will affect some companies more than others. Some companies, specifically those related to basic commodities should fare well in recessionary times. This market has turned into a stock picker’s market. This, meaning your ability to read the charts and seeing which stocks are still uptrending while others fall into downtrends becomes a dominant skill. Having a great charting and execution platform like DAS becomes important as well, as you will need to be able to get into and out of stocks nimbly as market forces change quickly due to news and earnings reports.

Hot Sectors to Watch

- Basic commodities such as miners, food producers and makers of basic materials. Consumer cyclicals will also hold up better than other sectors.

- Due to the war in Ukraine, all defense manufacturers will do well as defense budgets around the world have increased drastically.

- As a result of inflation, gold and silver have already gone up a lot and will continue to increase in value.

The Gold Miners ETF ($GDX). It might be starting an uptrend and may be a good ETF to watch for a further move up.

The Gold Miners ETF ($GDX). It might be starting an uptrend and may be a good ETF to watch for a further move up. - Finally, the most obvious is oil and natural gas. This will continue to go up until the point where we start to see demand destruction. Once demand destruction starts to take hold, we will start to see oil and natural gas prices level off and maybe drop.

Trade Well!

What’s New from DAS

While we didn’t release any production updates during the month of April, we did release two beta versions: 5.7.0.1 and 5.7.0.3 for testing. In these beta releases, we implemented the following changes:

Beta Release 5.7.0.3

Hotkey

-Added SoundFile chart alert hotkey to set alert sound file.

-Added ConfigTrendLine hotkey for Rectangle interior fill color and transparency.

Charting

-Added options lv1 to chart..

-Added AutoReset to chart alerts.

Display Windows

-Fixed positions line/label color issue.

-For Order Templates window (New Cfg window):

1. Added new item ‘X —Complex Order’ in Exchange List.

2. Disabled modified status in Exchange List.

3. Set ‘AON/ANY’ and ‘Account’ to AllowEdit mode.

API

– CMDAPI: Added “CreateTime” field for positions (in this format: 2022/04/07-09:56:43).

Bug Fixes

-Bug fix – Fixed issue with Montage window->TMP button (right click), “Use Global Default” does NOT uncheck after “Apply This Setting To All Exchanges.”

-Bug fix – Fixed issue with Setup->Order templates, the value of sub items are not changed after switching Exchange, also cannot save sub items.

-Bug fix – Fixed WPos hotkey can’t read negative coordinates.

-Bug fix – Fixed issue where Negative number sometimes not displayed correctly.

-Bug fix – Fixed issue where Re-login may sometimes cause crash.

Beta Release 5.7.0.1

Risk Control: Increase max value for account risk ctrl parameters.

Hotkeys: Added hotkey “LeftLocateQuery” to Montage window to get number of locate shares left to short.

Options Chain: Added auto center grid to ITM/OTM options.

Montage: Optimized advanced ladder view.

Admin Feature

Updates to the Account Monitor:

1. Training only checkbox works for Branch, Symbol, Trader

2. Symbol filter allow wild card like *,? []

3. Added feature for AccountMonitor to detect accounts having options in the money and when exercised will create positions that will exceed buying power.

Bug Fixes

-Bug fix – FocusWindow hotkey focus on window from other tabs.

-Bug fix – Hotkey interferes with changing/entering password.

-Bug fix – RSI changes when vertical zooming price chart.

-Bug fix – Adding Price Marker study causes crash sometimes.

Beta version 5.7.0.1 and 5.7.0.3 of DAS Trader Pro are available for download.

Please be sure to install the latest version of the DAS Trader Pro platform. You can do this very easily from DAS by clicking Tools > Auto Upgrade. You can learn more about the Auto Upgrade feature in our Knowledge Base.

Watch our Streams on YouTube

You can view the most recent newsroom stream here as well as all of our newsroom streams from this link. Also be sure to subscribe to our YouTube channel for educational and trading videos as well as all things DAS! And also be sure to follow us on all major social media platforms by following @dastrader.