Market Analysis

What does the future hold for 2021?

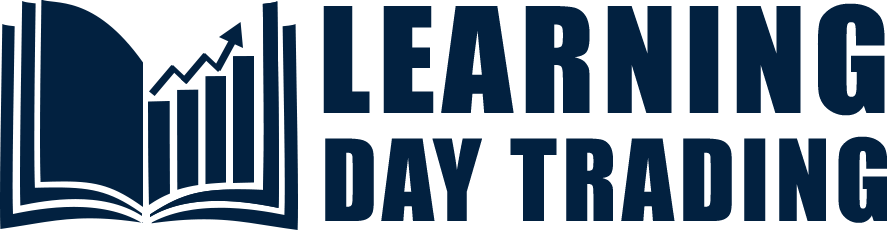

Currently all three major indices are above their all time highs. This chart of the $QQQ shows that after making new highs, the tech heavy $QQQ NASDAQ100 ETF has sold off during the last week, which might be indicative of further downside to come.

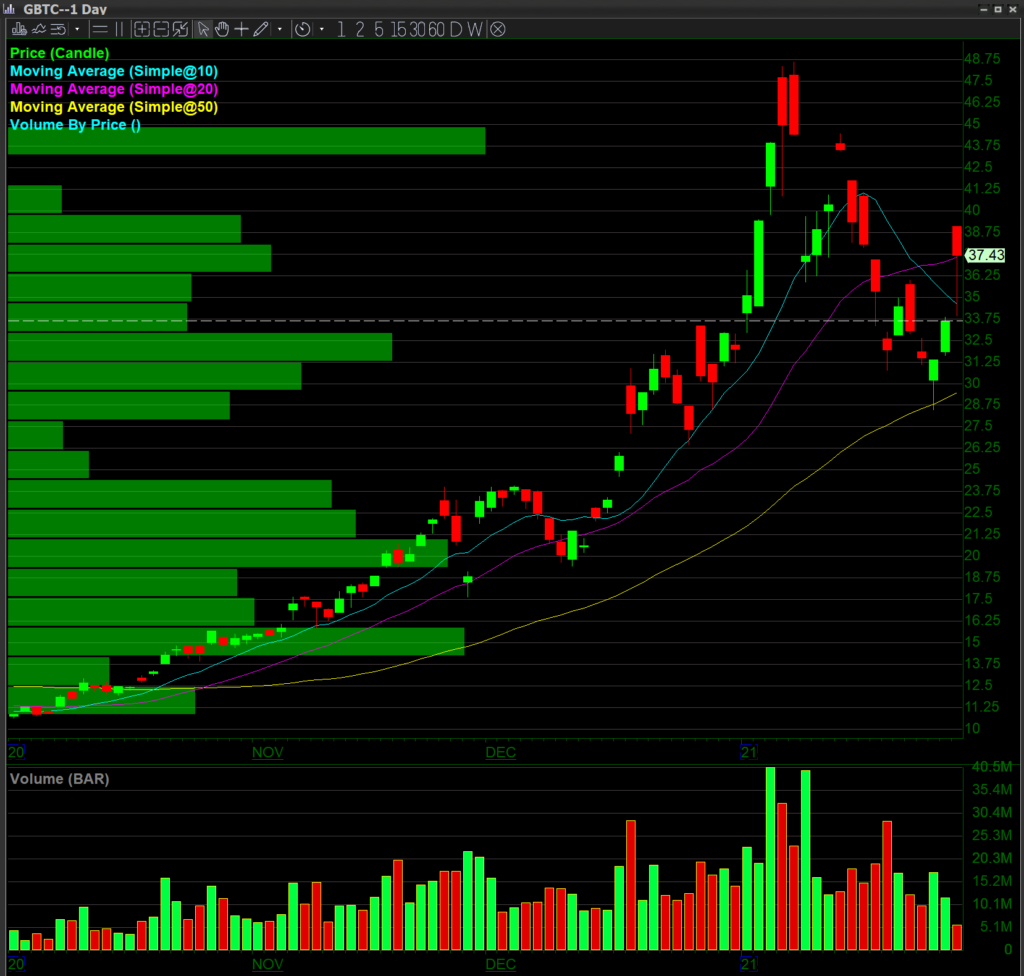

*Please Note: All of the charts featured in this month’s newsletter include the “price by volume” (PBV) chart indicator, which is a horizontal histogram plotted on a security’s chart, showing the volume of shares traded at a specific price level. Oftentimes, price by volume histograms are found on the Y-axis and are used by technical traders to predict areas of support and resistance. This month, this indicator is of additional interest as it illustrates the volume gaps caused on the short squeeze stock targets. We will be teaching about this and other indicators in our upcoming services on the DAS Trader YouTube channel.

This is due to the U.S. Dollar weakness caused by unprecedented government spending. Stock markets have become a store of value and entertainment as active retail traders have become the prime movers on names. The big one in the news has been GameStop ($GME).

The following is a summary of what happened with $GME: Institutional investors led by a well-known research report started putting on shorts; as the future looked bad for this well-known retailer. Wallstreetbets (WSB), as the name implies, came out saying that GameStop was long and started to squeeze the institutional short traders out of the stock. A classic short squeeze followed, pushing the stock price from $11 to a high above $500.

The WSB group forum has since gone private, but they’ve since added a few more plays such as: $AMC, the troubled movie theater chain and $NOK, the formally well-known cell phone manufacturer.

What is a short squeeze? In order to short stocks (selling the stock without 1st owning it), you need to borrow them from somebody who owns them long-term. That borrowing has a cost called short interest. Institutions and professional traders will borrow shares to short stocks that they believe are going to go down. In this case, a massive amount of retail investors drove up the price of the stock by buying them and squeezing out the institutions and professional traders who are then forced to buy to cover their shorts, driving the stock price even higher. This was effectively done on GameStop $GME and being done on $AMC and $NOK earlier this week.

The first earnings season of 2021 seems to be all about forecasts for the future, as the massive growth of 2020 for many tech companies is not sustainable. The immense push to digital caused by the pandemic and by lockdowns is likely to diminish as we go into 2021 and beyond.

Also, there was a bit of infighting between companies like Facebook ($FB) and Apple ($AAPL) that is starting to take its toll on tech company’s earnings expectations. The differing views about security and privacy are beginning to take precedence as well.

$BTC and the $GBTC tracking stock have also served as a store of value in these difficult times; it looks ready to rally once again from these levels.

$GLD, which is also a hedge to dollar weakness, is still in an accumulation pattern on the weekly.

What’s New From DAS

Improvements

The development team at DAS has been very busy this month with several improvements and changes to the DAS Trader Pro platform. First, we will mention our upcoming improvements to the platform such as new features or additions that will be available in our *beta release, but we will have these features released into production shortly.

Below is a list of the changes that were added in this month and is available in the most recent DAS Trader Pro *Beta version that will surely enhance your experience with the platform:

-Added additional information for when trading is halted.

-Added a ‘ToggleDragMode’ hotkey toggle so you can toggle between the hand and arrow cursor.

-Added configuration for maximum number of global trend lines. This can be found in: Setup>Other Configuration.

-Added an icon for the Result window in Trade Signal.

-Added fundamentals data to display in the Result window for Trade Signal.

-Added sector display in Trade Signal.

*If you are interested in testing a pre-release beta, please contact our Sales Team: https://dastrader.com/#Contact for the link to the Beta version download. We are always looking for beta testers as well as for feedback on our platform. Please reach out to us to let us know if you wish to be a beta tester, or if you have any feedback for us to help improve your experience.

Bug Fixes

Secondly, we wish to provide you with an update on bug fixes that we have recently implemented to the current production version of the DAS Trader Pro platform. Below is a part list of these bug fixes. As always, you can review our Release Notes which contains the complete history of updates to the DAS Trader Pro platform:

-Version 5.5.2.1: Risk control crash fix

We will continue to send out updates each month with any platform updates and improvements.

Watch our Streams on YouTube

We are happy to announce that we have recently changed the format for our live streams! You can view the most recent live stream here as well as all of our live streams from this link.

If you have any ideas for anything you want to see on our live stream, please send us an email: newsletter@dastrader.com.

Can DAS be your Valentine? Join us in the Share the Love Giveaway for February!

Beginning Monday (2/1) we will be having a DAS Trader Share the Love social media giveaway! This giveaway will only run for 2 weeks (through Valentine’s Day, 2/14) so don’t miss your chance to win 1 free month of DAS Trader Pro! Be sure to follow us on all social platforms to learn more and participate