The most important building blocks of trading are price and volume through time. In real estate, people often say the key is location, location, location. In trading, price is extremely important as is understanding the strength of a move; the most important element is volume, volume, volume.

It’s important to understand that price ignites all moves in trading, however, volume is what confirms the strength and longevity of that move.

Think about the battle metaphor: price is defined as a battle between buyers and sellers or is a battle between supply on the sell side and demand on the buy side. You, then, have to realize that understanding volume patterns is the key to understanding how much supply or demand it took to win a certain price level or to hold a level of price support. Volume is the record of all transactions that are completed.

Now, let’s think about this for a moment. Volume equals completed transactions which means real money changed hands in order to establish the price level on the chart. Volume cannot be faked without money changing hands. This is in contrast to the price in which a small transaction of 1 share will be printed on the chart the same as 10,000 shares. You will not know the difference or significance of that level unless you look at the size of the volume. Therefore, experienced traders learn to carefully read the nuances of volume.

There are certain times of year (the end of August, the time between Christmas and New Year’s and any shortened trading week) where the market tends to trade on lower volume levels. It is during these times that you need to pay attention to volume more carefully than usual. There will be significant price moves that are not supported by volume. Learning how to read volume in all markets is important but it becomes significant during these times of low volume.

Volume Patterns

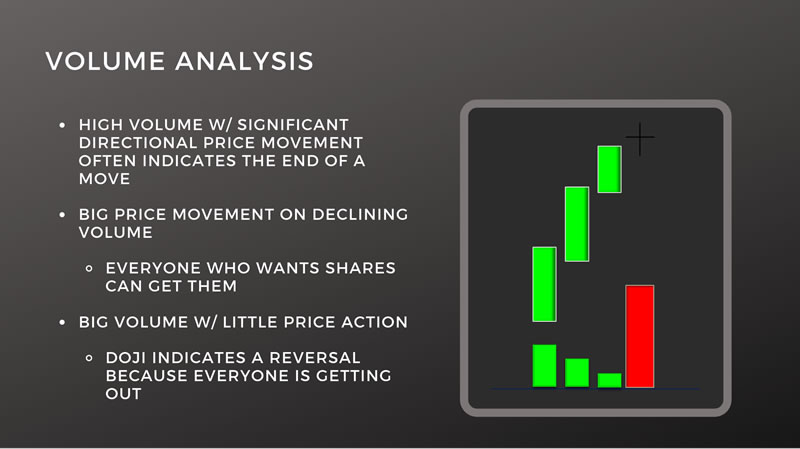

High volume with significant directional price movement will often indicate that the move is coming to an end or is starting to become mature. Big price movement on declining volume means the stock is losing strength. Anybody who wants to buy the stock can buy it at that level but there are fewer buyers while stock is at these inflated prices. If this pattern continues to persist, it will lead to a reversal. Any price movement on low volume is not to be trusted. Conversely, big volume on no price movement should expect a reversal is imminent.

Summary

Volume is one of the most valuable tools in identifying and predicting potential price reversals. Volume patterns help traders identify potential tops and bottoms in the market. It is an objective indicator for identifying market conviction. Price movements are much more important when supported by heavier than usual volume. Trade well.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More