When considering trend analysis, the first thing every trader needs to remember is that trends and trend direction are more important and powerful than patterns. We must always go with the direction of the prevailing price action. Although trends are more important than patterns, it is important to keep in mind that patterns are good gateways to enter a trend.

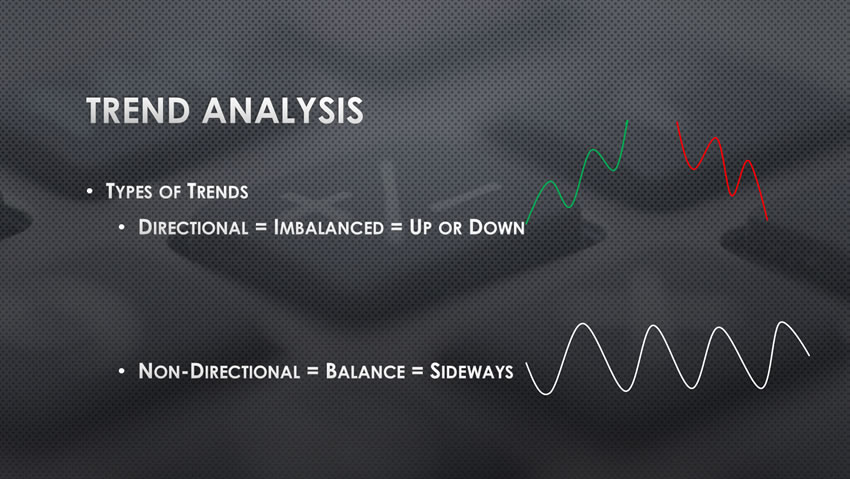

Let us begin with the two types of trends: 1) Directional and 2) Non-Directional.

Directional: There are two types of directional trends: the uptrend and the downtrend. The market can be imbalanced to the upside which means there are more buyers than there are available sellers. Due to this, the market makes higher highs and higher lows. An imbalanced market to the downside has more sellers than there are available buyers. In this case, the market makes lower lows and lower highs.

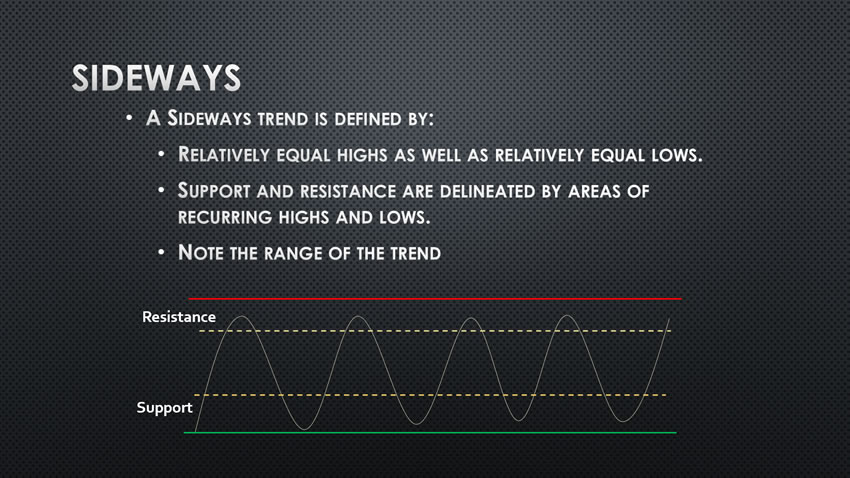

Non-Directional: There is only one type of non-directional trend called a sideways consolidation or sideways trend. A balanced market has an equal number of buyers and sellers, but the balance of power between the two swings back-and-forth. This swing goes on until it is clearly resolved in one direction or the other and is known as a breakout.

The Uptrend, The Downtrend, and the Sideways Trend

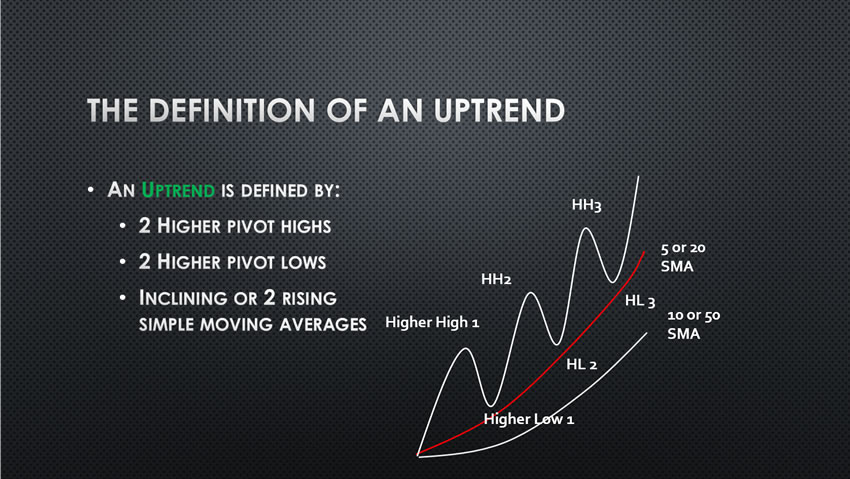

An uptrend is defined by 3 things: you must have 2 higher pivot highs, 2 higher pivot lows, and have a pair of gently rising moving averages. Usually the 10 and 20 simple moving averages work best together. The 10 must be above the 20, indicating positive price action.

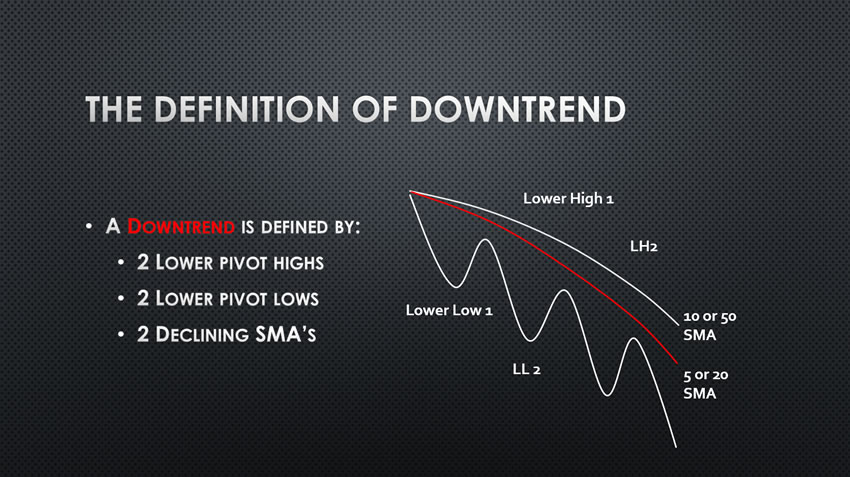

The definition of a downtrend is the exact opposite of the uptrend. You must have two lower pivot highs, two lower pivot lows, and two declining moving averages with the 10 being below the 20.

A sideways trend (or sideways consolidation) is any lateral pattern that has relatively equal highs and lows. Keep in mind that support and resistance is delineated by areas of recurring highs and lows. It can be compared to a flexible fence rather than a glass wall, meaning it has some play to it.

Above, the QQQ chart illustrates a great example of an uptrend followed by a brief sideways trend. There is, then, a continuation back to the upside with a second uptrend which is now growing mature. Notice the position and direction of the moving averages as well.

We will continue a deeper dive into trend analysis in our upcoming blogs. Trade well.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More