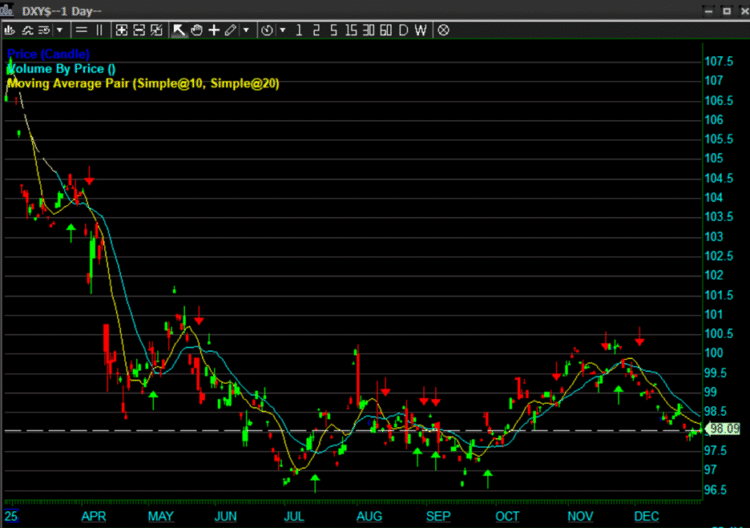

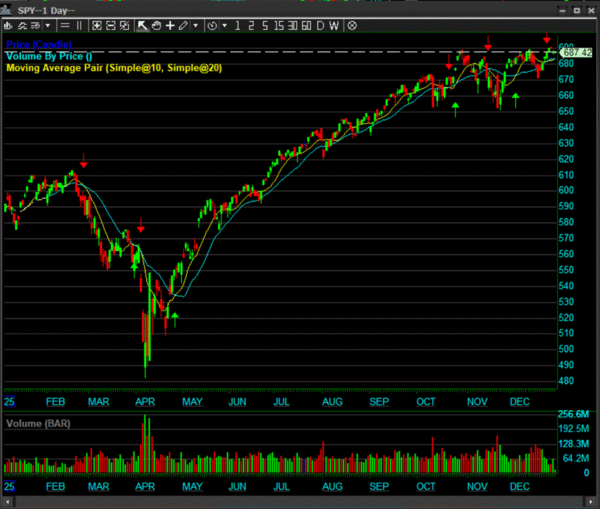

The U.S. equity markets in 2025 are closing at their highs, while the U.S. dollar is closing near its lows. That, by itself, should tell you something.

With the exception of the February to April sell off, the US markets as shown here on the $SPY have been pretty much up, up and away.

The Dollar Index or DXY$ shows how the Dollar has lost value inverse to US Equities.

The “Gold Standard”

Let’s take a look at some other asset classes and see how they performed. The hedge against the U.S. dollar has traditionally been gold and silver. Why is this? Prior to the dollar becoming the international currency of trade, gold was the standard—hence the term “the gold standard.” Gold is also at an all-time high. So, if we were to denominate stock prices in gold instead of U.S. dollars, the stock market would not appear to be up. In fact, gold and silver have gained more in value this year than almost any other year since the 1970s.

Smoke & Mirrors

The stock market rally of 2025, in a sense, has been a bit of smoke and mirrors. The tremendous rally in stocks was primarily driven by a devaluation of the U.S. dollar. This devaluation was caused by a number of factors, the first being excessive deficit spending by various political administrations. Another major factor was the imposition of tariffs by the Trump administration, which dominated the news during the first half of 2025. The use of tariffs as a bargaining tool to gain trade concessions caused many nations to reduce their U.S. dollar holdings and increase their holdings of gold and silver, thus driving up precious metal prices while pushing down the value of the dollar. As the dollar declined, stock prices—denominated in dollars—naturally rose.

Here we see the parabolic rise of Silver shown via the $SLV.

Silver Shines

Overall, the best place to be was in gold and silver, as both broke out to the upside for very strong fundamental and technical reasons. The question is: what comes next? Traditionally, silver outperforms gold in a bull market and underperforms gold in a bear market. That is exactly what we saw this year, particularly in the latter part of the year when silver skyrocketed to new highs. One reason for this is that silver has powerful industrial uses beyond its role as a monetary hedge. Silver is an excellent conductor and is used extensively in many of the new semiconductor plants announced this year.

The Look Ahead: 2026

Looking ahead to 2026, we do not see this trend continuing—at least in the short term. It appears that the dollar has bottomed, and while the U.S. economy remains fairly robust, it is clearly slowing. The hype surrounding the AI boom also seems to have lost some of its luster, as companies are beginning to realize that the power demands required to support artificial intelligence systems are enormous. Significant upgrades to energy supply infrastructure will be necessary to keep this momentum going.

AI

AI also presents opportunities for companies to reduce support staff or replace redundant roles with AI-driven systems. This has contributed to a slowdown in hiring, which is a major concern for the central bank and could influence its decision to continue cutting interest rates. Additionally, wages have not kept pace with inflation—another concern for the Federal Reserve, which has already indicated that it will likely not cut rates much further in 2026.

Real Estate

Real estate prices will most likely decline in 2026. There is a tremendous amount of supply on the market, and at current prices there is a limited pool of buyers—not because people don’t need homes, but because they simply can’t afford them. Whenever you see illiquidity in the housing market, it generally does not bode well for equities.

Consolidation

From a technical perspective, a pause or period of sideways consolidation would be ideal. The U.S. economy has shifted dramatically over the past year, and the financial markets need time to adjust to this transition—from heavy government spending and globalized supply chains toward a more U.S.-centric economy, where the country produces more of its own goods and services and relies less on foreign trade partners.

Overall, what we expect in 2026 is increased market volatility, less clear direction, and more of a stock-picker’s market—where some industries perform exceedingly well, while others struggle, retool, or suffer due to massive policy changes that impact their supply chains. How individual companies adapt to these changes will ultimately determine their performance.

A Trader’s Market

In short, 2026 looks to be a trader’s market. Opportunities will exist for those who can move in and out quickly. There will be strong investment opportunities as some companies adapt exceptionally well while others flounder due to shifts in U.S. foreign trade policy. However, this will play out on an account-by-account and company-by-company basis, not across the market as a whole. In the worst-case scenario, we should prepare for an economic slowdown—and that means holding ample cash, both to trade opportunities and to weather potential storms.

On that note, trade cautiously and remain prudent. As always, we here at DAS Trader wish you a very happy and healthy New Year in 2026.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More