Many people dream of trading for a living, but the reality is very different from their dream. This article is going to go over the reasons why people want to make a living from trading, as well as the unfortunate reality for many traders. Trading is the hardest way to make an easy living, but if approached correctly, it is achievable.

Why do so many people dream of trading for a living?

The Dream for some.

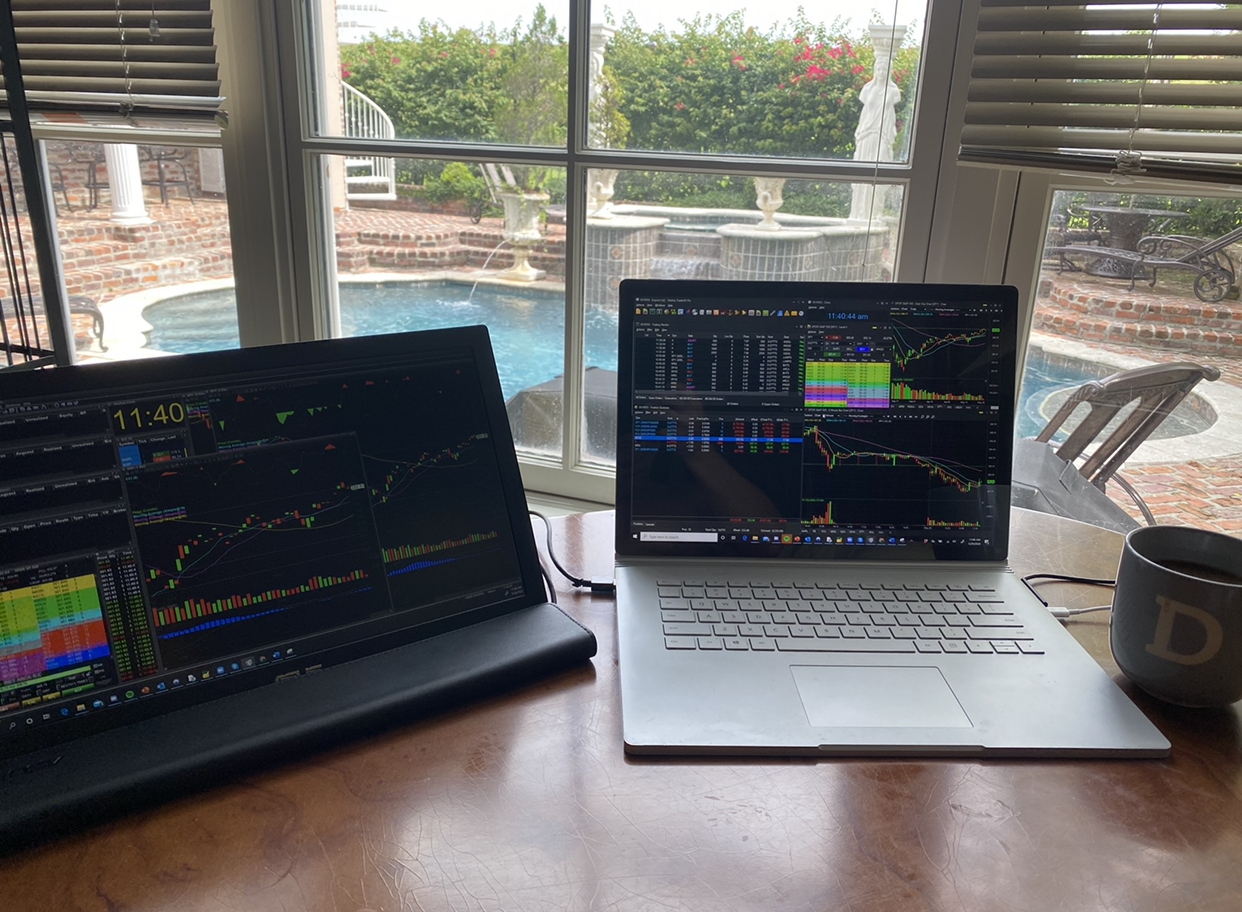

First, you can trade from anywhere in the world (as many of you know this is what I do some of the time). You don’t have to deal with a boss, or have to deal with annoying coworkers or troublesome customers. It’s just you, your money, and the market. Therefore, many people dream of living the trader’s lifestyle; traveling the world with a laptop and side monitor, while traveling to exotic and beautiful places. All of this while pulling a few thousand dollars out of the market each day. There’s also the possibility of swing trading and making a few thousand dollars each week while traveling, living life, and trading to make your money.

The Reality for most.

Getting up each day and going to your basement (which is me much of the time), or your office where you have your trading computer. You sit by yourself most of the day, while watching CNBC on TV, reading financial news and pushing hot keys or by clicking away buying and selling stock by yourself. You must deal with your emotions and the emotional roller coaster of your P&L going up and down. You worry about your future and whether or not you can pay your rent or pay your bills and how long you’ll be able to keep it up if your losing streak continues.

The Best Way to Approach Trading if you have a job.

If you’re currently working and you’d like to pursue trading then the best way to approach it is as an extra income; a part-time position. Try to free up your schedule so that you can trade the morning, since the open generally is the easiest for learning how to trade equities. The moves off of the morning opening bell and the trend that’s established for the day are generally the most clear and easiest for a person to trade. You can keep your main source of income and try to make extra money by trading the open and catching the morning trend.

As a trader, you need to learn to create multiple streams of personal income. What this does is create a mindset of success. If you have money coming in from rental properties, have money coming in from a small consultancy or even a nighttime bartending job, then your trading will be far improved as you will not solely be relying on trading to pay your bills.

There is nothing harder to do as a trader than make money when you don’t have any money coming in to pay your bills. Lately, we’ve heard a lot about Robinhood traders or other retail investors doing YOLO style trades. What is a YOLO trade? YOLO stands for “You Only Live Once”. In trading, a YOLO trade is where you go all-in hoping to make a substantial return. This is the opposite of approaching the markets in a responsible way. It’s taking a long shot and it’s not a responsible approach to trading for a living; it usually does not end well. On that note, we urge you to trade responsibly and approach this like a profession as an extra job and a great way to achieve your financial goals.

Written by Michael DiGioia, Director of Institutional Sales

Mike is available for One-on-One Coaching. Learn More