As always, we’d like to remind you that trend is the most important factor when planning a trade. Start with a trend when doing your top down analysis as patterns are gateways into trends. Reversal bars are very important technical refinements to your trading patterns. They help you identify high-quality trading patterns versus more frequent, lower quality setups. In the last blog, we discussed hammers, shooting stars, and Doji Stars.

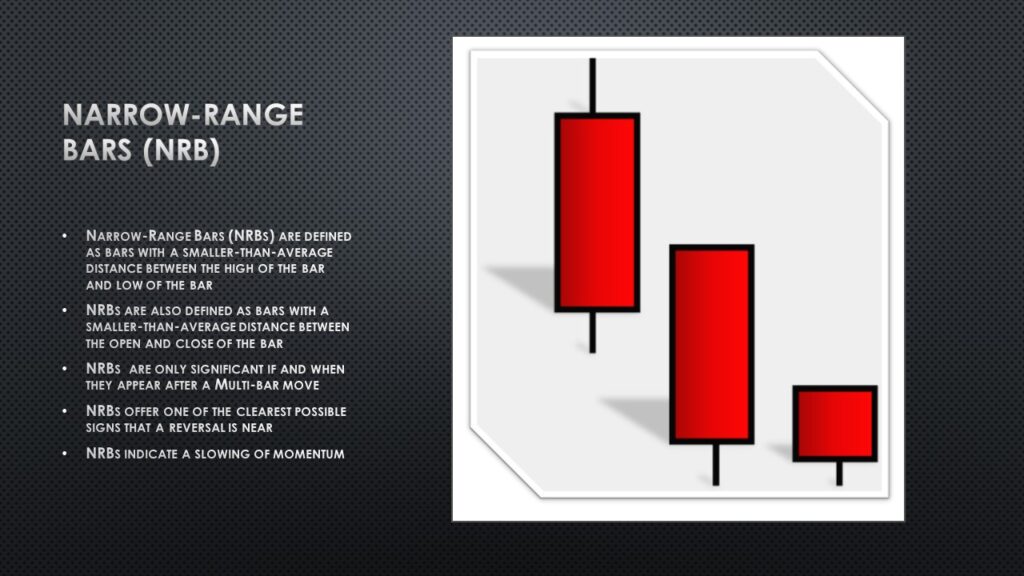

Now, we are going to discuss narrow range bars which is exactly like it sounds; bars that have narrower ranges than the average bar. These bars indicate slowing of momentum, but they also indicate a possible reversal is coming soon. So they can mean “ wait and watch” to the trader. They are a trigger until a new bar crosses above the high of the prior narrow range high. Usually making the trigger a bullish reversal candle. The nice thing about NRB (narrow range bars) is that their narrow range makes taking a trade off of them lower than average risk. As your entry is above the prior bars high, your stop is below the prior bars low. These points define the risk reward ratio of the trade.

Risk is defined as entry – stop = risk per trade.

Reward is defined by target – entry = reward.

Generally, you look for a 2 to 1 risk to reward ratio in order to take a trade. Remember, your target can also just be your first target when scaling out, as you will try to run part of your position with a trailing stop.

Some standard scaling out tactics are selling ½ at the first target and using a trail stop on the back half.

Another scaling technique is selling ½ then ¼ and another ¼.

Some traders also just sell in ⅓ increments, so three transactions.

By scaling out you reduce the risk, take some profit and then you are more likely to hold to the technical target or make a larger gain with part of the position.

That covers things for now, more on reversal bars next lesson. Trade well.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More