The Federal Reserve has held rates steady at its first meeting of the year, and has indicated that it might not be cutting rates as expected anytime in the near future, as the markets have come to expect. The US stock markets have backed slightly away from their all-time highs yet again on this news.

Earnings results have been generally good but also mixed. One company’s results that stood out from the rest and were disappointing was Alphabet ($GOOG), which were worse than expected and have helped to trigger a small sell-off in technology stocks, even prior to the Fed announcement. But the selling from lackluster results is taking markets off of their all-time highs, as consumer confidence continues to buoy the entire economy.

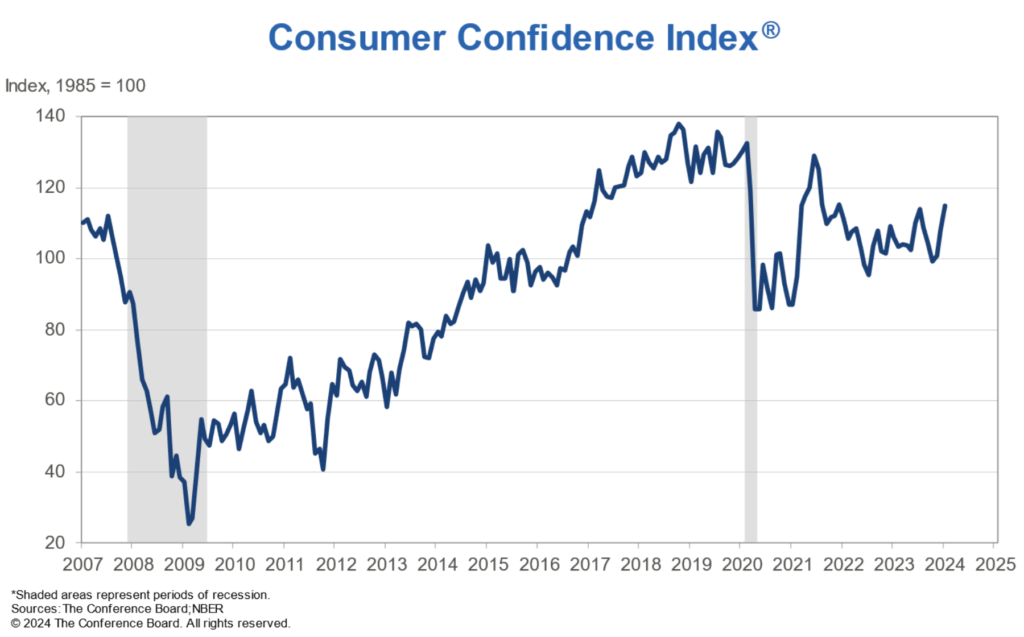

The Consumer Confidence Index (CCI) reported by the Conference Board shows that consumer confidence is at its highest level in three years, even though there are many underlying cracks showing in the economy.

Tech companies have been laying off employees at an increasing rate; here are some other things to factor in as well:

The reaction of the Federal Reserve to the continued perceived strength of the economy as indicated in the most recent report.

Generally, the Federal Reserve is inclined to continue to raise interest rates, not lower them, if the economy continues to show signs of strength. This would be a negative for the stock market. In fact, not only would it be negative, but it’s diametrically opposite to what the stock market had been expecting since December. The stock markets have already factored in that the Federal Reserve will be dropping interest rates at least two to three times in 2024, but with today’s Fed announcement, that might no longer be in the cards.

The Middle East

The geopolitical situation of the Middle East continues to weigh on the market, as it becomes more complex and expanded in scope. The recent attacks on the US by Iranian-backed forces in Jordan and the potential retaliation of the US could spread the conflict to more countries.

From a technical perspective and as pictured above, US markets continue to remain in a bullish uptrend, but are nearing the uptrend line for a possible challenge technically. Also, from a fundamental perspective, markets continue to have some significant threats on the short and intermediate term time horizon, the first being the geopolitical conflict in the Middle East and the second being the uncertainty around the US election. So it is a good traders’ market, with clear trends and an increase in volatility very possible at some point in the near future.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More