The U.S. stock markets have pretty much stayed in a range for the entire month of April, and now in the middle of the earning season.

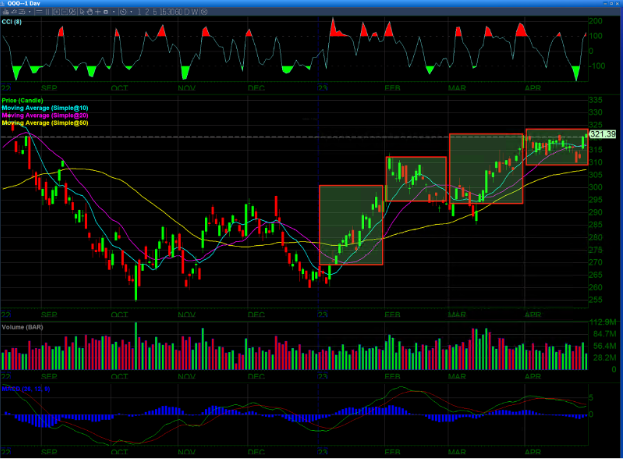

This chart of the $QQQ shows the market rally that has been going on for the last 4 months, but the CCI and the MACD confirm that it might be running out of energy. The MACD has started to turn bearish and the CCI has diverged from price and is overbought again

This chart of the $QQQ shows the market rally that has been going on for the last 4 months, but the CCI and the MACD confirm that it might be running out of energy. The MACD has started to turn bearish and the CCI has diverged from price and is overbought again

Many tech companies such as Microsoft ($MSFT), Alphabet ($GOOG), and Meta ($META) have had earnings with favorable results. The question that remains is whether this trend will continue for the remaining tech companies that have yet to report earnings this quarter.

Usually, technical analysis would indicate that a market that rally’s into the earnings season would be getting ready for a pullback, as the rally might be running out of steam.

Usually, technical analysis would indicate that a market that rally’s into the earnings season would be getting ready for a pullback, as the rally might be running out of steam.

Finally, the markets are waiting on the results of the next meeting of the Federal Reserve. Consensus states that there is a 75% chance that there will be a 25 basis point rate hike. Remember, the Federal Reserve has a tendency towards overkill when it comes to raising interest rates. So for market participants to hope for a rate cut now is very premature historically.