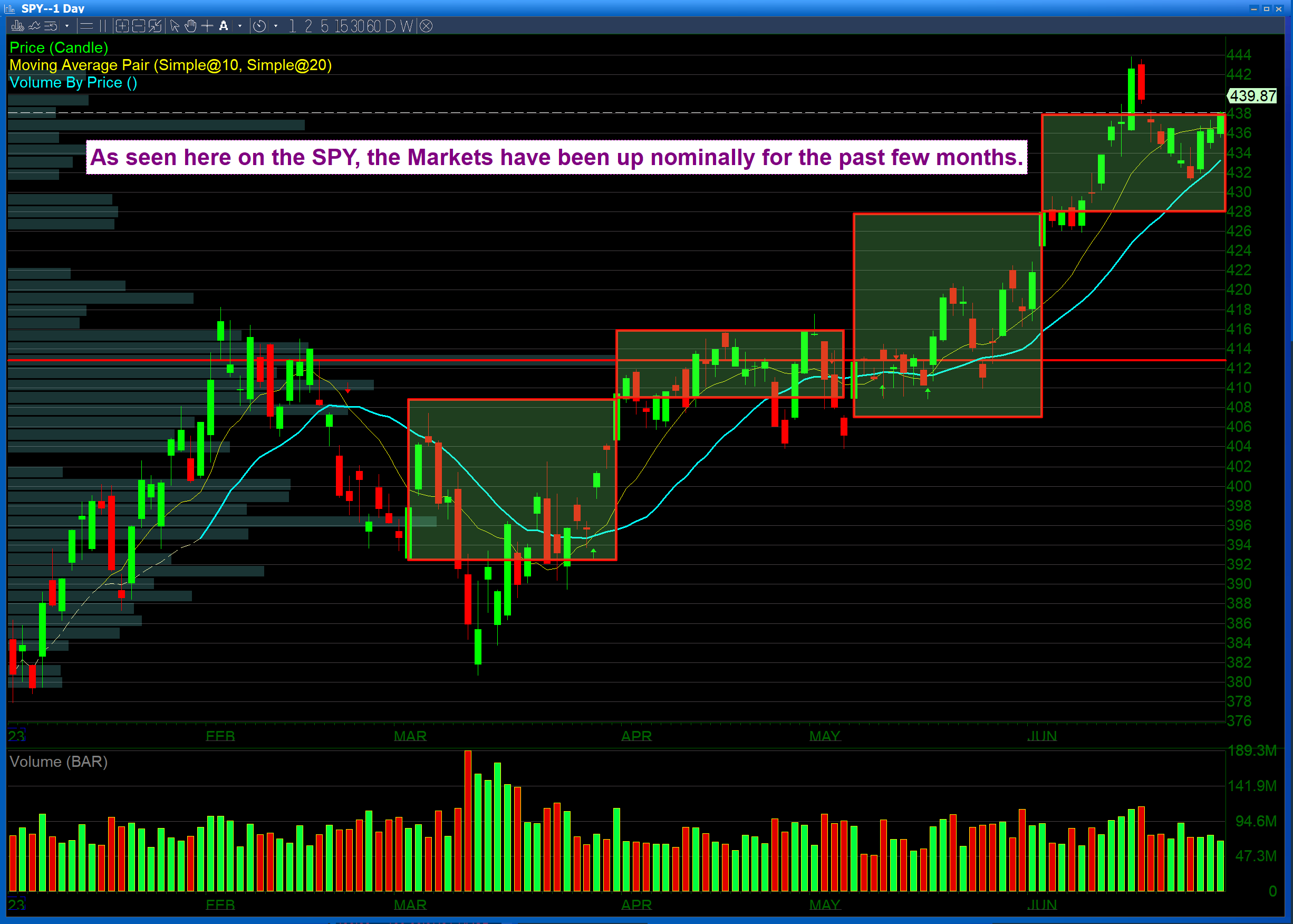

As seen in the chart of the $SPY above, the month of June was a slightly up month for the S&P, which is the broader index. What this signifies is that the S&P represents all sectors and is not so heavily weighted or dominated by technology like the Nasdaq is, which is pictured above with each month in a green shaded rectangle.

For the Nasdaq, the move up was more pronounced, but is showing early signs that the rally is running out of steam as the volume has decreased, and a possible lower high was established when Nvidia, the leader of the AI rally, made a drastic pull back on news that AI chips might soon be regulated as well.

Overall, the rally has gained some breadth, but has largely been dominated by the technology sector, and more specifically the hype around artificial intelligence. Notice the word “hype”; this word is really what artificial intelligence is at this point; now that’s not to say that it does not have huge potential. However, key hurdles, such as regulatory guidelines and actual practical uses need to still be defined. The recent rally was motivated more by the potential of AI rather than by actual increases in productivity or cost savings as a result of the said potential productivity increases. Yet as far as the markets are concerned, perception becomes reality.

What traders and investors need to be aware of is that the perceived value of AI does start to fade as reality sets in, as they realize that AI is not quite where perception currently thinks it is. Furthermore, this market has some weak foundations, meaning that as soon as the Federal Reserve starts to increase interest rates again as they have already indicated that they would, the markets could potentially start to roll over. Also, a slightly lower high after a double top is a topping pattern.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More