Every day there are three things that the market can do:

- Gap Up

- Open Flat

- Gap Down

Learning how to trade this daily occurrence gives you a reliable trading strategy each right at the market open. Trading in fading gaps is a classic trading style.

Let us begin by covering the difference between a gap fade and a gap fill. A gap fade goes in the opposite direction of the gap, but it doesn’t necessarily have to completely fill the gap. In Japanese candlestick analysis, gaps are called windows. Windows can be closed completely or left partially open, which is what many fades are. When fades close completely we call that a gap fill. Gaps often have a tendency to fill, but it may not happen on the first day or fill at all.

Gap trading has many similarities to reading volume patterns. In fact, the names of the different gaps correspond to the same names as volume strategies (please see our blog about volume trading patterns here).

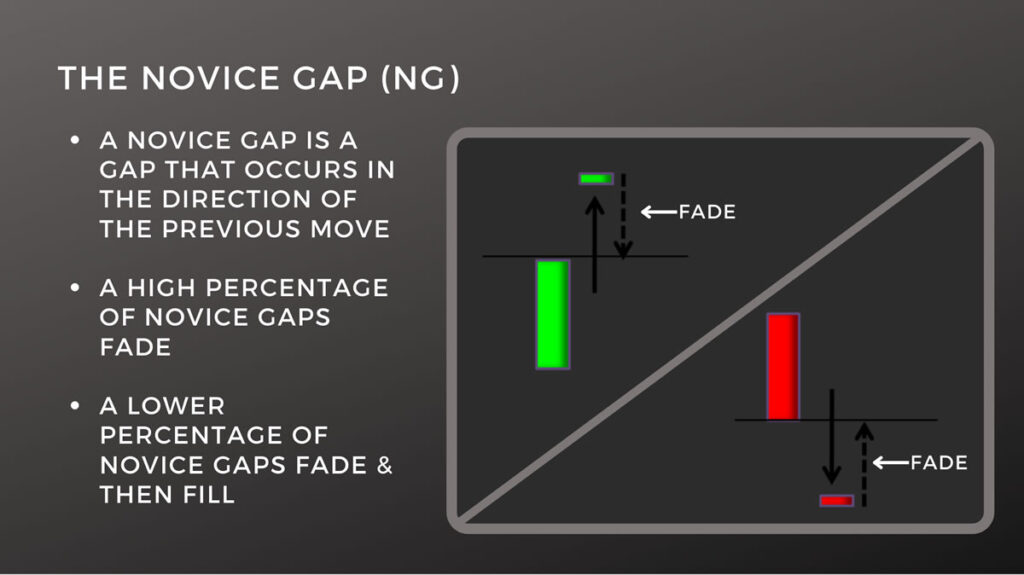

The Novice Gap

A novice gap is when a stock is gapping up after a long move. It occurs in the direction of the previous move. A high percentage of novice gaps fade. A lower percentage of novice gaps fade and fill.

The Psychology of The Novice Gap

The most important element to understand when thinking of a novice gap is that the stock is going up and it then goes up more. Beginning traders and investors watch this climb and finally get the courage to put in their order after the stock is already high. Their orders get filled and drive the stock up even more. The professionals who have already been in the stock are ready to take profit. The novices drive the stock up causing the gap up at the end of the move and the pros cause the fade as they take profit because they’ve already been in for a long time. The key element to understand here is that professionals ignite the move and usually novices get in just as the move is ending.

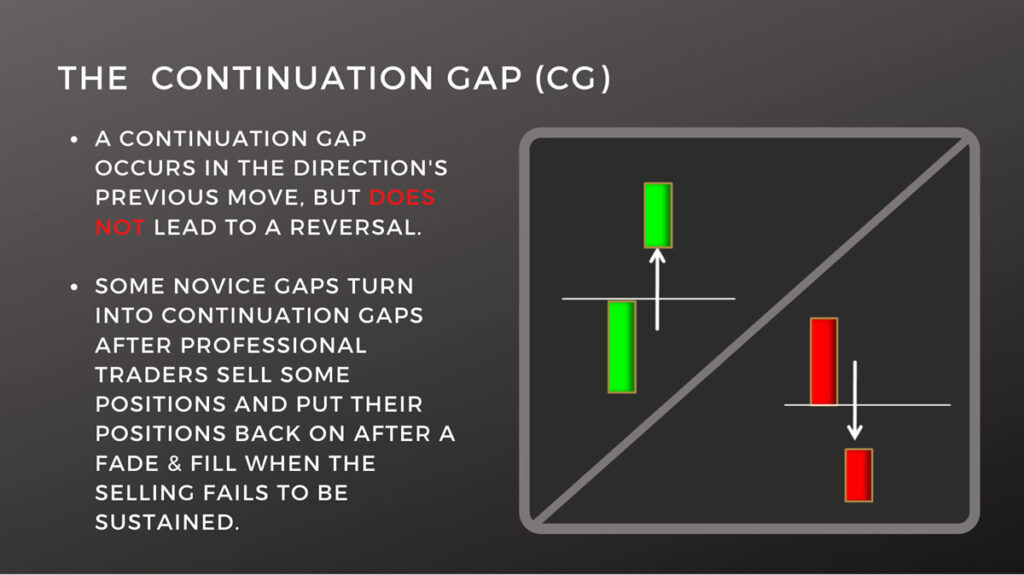

The continuation gap begins with a novice gap which reverses and continues in the direction of the previous move. Sometimes the continuation gap can go all the way until the gap fills before it continues in the direction of the prior move. This makes continuation gaps hard to read until they are actually happening.

Very often a continuation gap will start as a smaller than usual novice gap and then will fade or fill only to reverse and go back in the direction it had been moving previously. This move will ultimately stop at a major area of support on the downside and resistance on the upside. It is important to note that the fade and fill time will usually only be in the first 30 minutes to 1½ hours of the day.

The Psychology of the Continuation Gap

The continuation gap starts very much the same as the novice gap. Pro traders have already ignited the move in a new direction and traders are buying the stock in that direction driving the price higher and the stock gaps up. The pros who have gotten it already take some profit which causes the gap to fade and fill down. The key difference is the pros don’t take off all of their position as they are running a part of their position to their target just before a major area of resistance. After booking some profit, they wait for the stock to gap fill and they add back into their position. This, then causes the stock to go up and continue higher until it finally gets to a major resistance level.

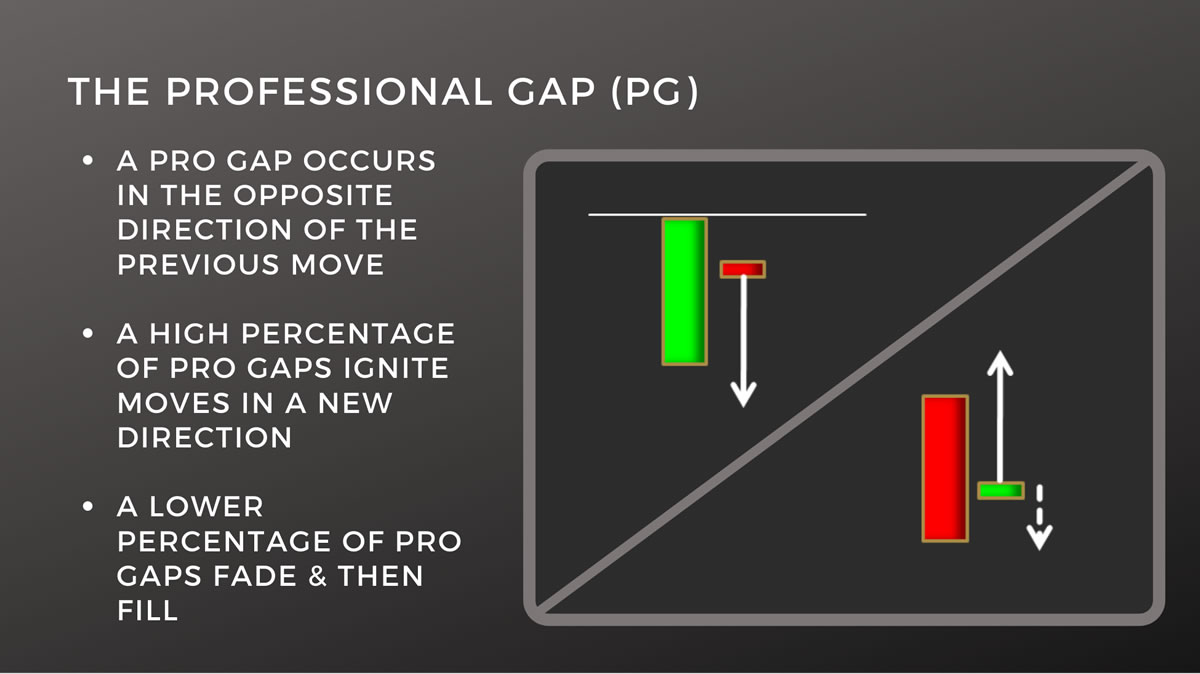

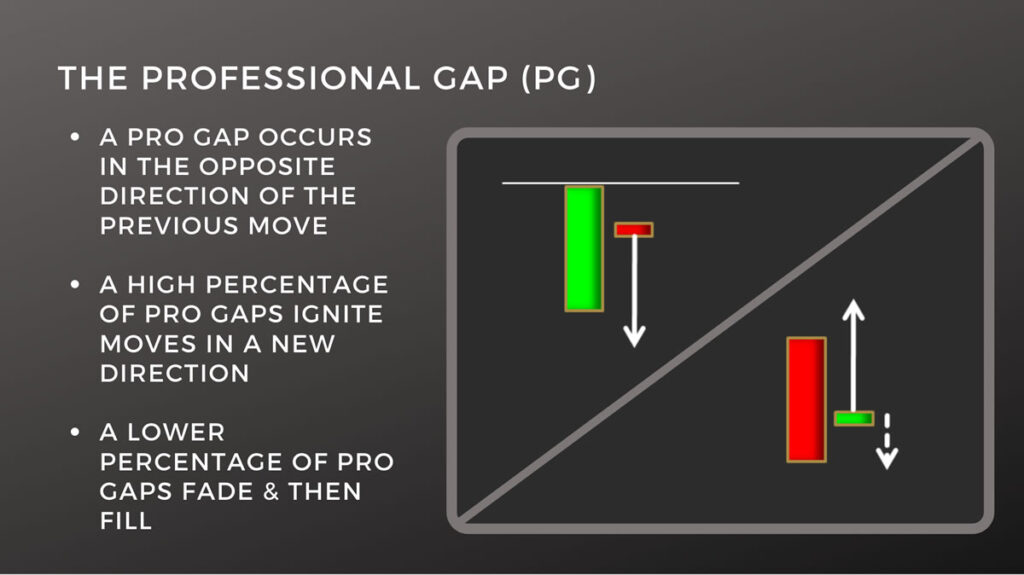

The Professional Gap

A pro gap occurs in the opposite direction of the previous move. A high percentage of pro gaps ignite a move in a new direction and a lower percentage of pro gaps fade & fill.

The Psychology of the Professional Gap

As an example, the stock is going down and everybody who is long in the position is losing money. They go to sleep having just sold their position and the following day, the stock gaps up. Who bought the stock in the pre-market gap to stock up? Generally, professionals have the money and the access to reverse a stock direction in the pre-approach market.

Well we hope you now have a good understanding of Novice gaps, Continuation gaps, and pro gaps, from both a technical and psychological perspective. We will do a deep dive into the individual gap trading strategies that allow you to trade variations of these three general types of gaps.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More