The Federal Reserve has been worried about inflation for the last 2 years. What is different now and how did we get here?

Root Cause Number 1

The Pandemic Shutdowns interrupted the Supply Chain (Root Cause was Transitory).

Root Cause Number 2

Governments around the world gave direct stimulus to people in need of assistance to deal with the Pandemic. This is called Fiscal Stimulus, which is the printing of money in the form of stimulus checks. This flood of money is now gone. But the effect this money had on the economy was an increase in demand, just as there was a decrease in supply due to Root Cause Number 1: Supply Chain interruptions.

Root Cause Number 3

Maintaining low interest rates, even while the economy was running hot due to fiscal stimulus to help with the pandemic is Root Cause Number 3. Interest rates are Monetary Policy, meaning they deal with the overall supply of money in the system. Money Supply has been loose for 13 years now, since the last financial crisis took place in 2008/2009. This has kept us from having a recession for a prolonged period of time. This problem is not transitory, and will take a long period of increasing interest rates to get money supply reduced.

Root Cause Number 4

The Russian invasion of the Ukraine, further increased supply chain problems and more importantly, impacted food and energy supply. This problem continues into its second year and further complicates the other three root causes.

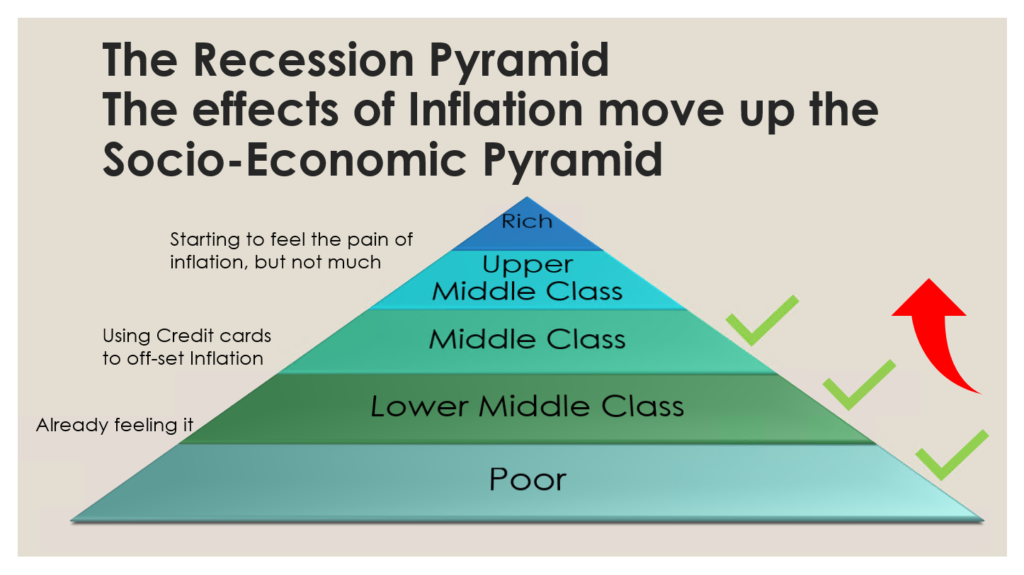

Now that we reviewed the Root Causes of the reoccurring rise of inflation, we will explain the current recession and how some portions of the population are already in a recession, while others are just starting to experience the pinch of inflation.

Recession starts from the bottom of the socio-economic pyramid and moves its way up. The poor have been in a recession for 9 months as inflation hits the poor the hardest. This is most evident in the increase in homelessness in major cities in the US. Most notably in Los Angeles, Chicago and New York. The lower middle class has also been feeling the recession for the last 6 months, but have depleted their savings and are using their credit cards to offset inflation. And the middle class has now been doing the same since the holiday season. The middle class has up until now not been affected, the upper middle class also has not been affected as the job market is tight and these socio-economic groups are highly paid professionals and independent contractors. However, up until now, the top three socio-economic classes have kept the economy going. But, as these top socio-economic classes start to deplete their savings and assets, they too will start to run up their credit card debt. If joblessness starts to increase then people will really start to feel the inflation and then all but the rich and super rich will be in recession. Their spending, meaning the rich and super rich can not carry the economy alone.

Recession starts from the bottom of the socio-economic pyramid and moves its way up. The poor have been in a recession for 9 months as inflation hits the poor the hardest. This is most evident in the increase in homelessness in major cities in the US. Most notably in Los Angeles, Chicago and New York. The lower middle class has also been feeling the recession for the last 6 months, but have depleted their savings and are using their credit cards to offset inflation. And the middle class has now been doing the same since the holiday season. The middle class has up until now not been affected, the upper middle class also has not been affected as the job market is tight and these socio-economic groups are highly paid professionals and independent contractors. However, up until now, the top three socio-economic classes have kept the economy going. But, as these top socio-economic classes start to deplete their savings and assets, they too will start to run up their credit card debt. If joblessness starts to increase then people will really start to feel the inflation and then all but the rich and super rich will be in recession. Their spending, meaning the rich and super rich can not carry the economy alone.

The latest sign of this is that 60% of Americans are living from paycheck to paycheck. As layoffs start, these people fall behind, the consumer which has been driving the economy will finally run out of steam. Inflation will finally be under control but the economy will be in a full fledged recession. Then the focus will shift to stopping the economic contagion. Credit card defaults lead to bank lending cuts and then finally a fall in real estate and other asset prices that finally hits the rich.

This is a pretty bleak picture for the economy, but many of the opportunities to avoid this were missed or completely ignored. The markets seem to be fueled by “hopium” or as former Fed Chairman Ben Bernanke called it, irrational exuberance.

Thank you for joining us for this deep drive into inflation, the money supply and the root causes of recession.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More