There is only one certainty in the financial markets: that is uncertainty, which makes for volatility. Knowing that big changes are coming, traders can plan for and expect price volatility.

The $VXX chart pictured above seems to be pulling back to support at the moment. Note that the current support is a higher low which could indicate the potential for a big spike in volatility soon.

How will the U.S. Midterm Elections Affect the Stock Market?

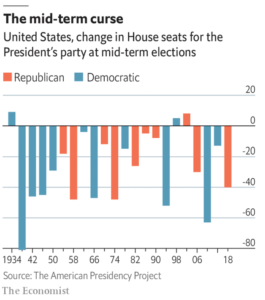

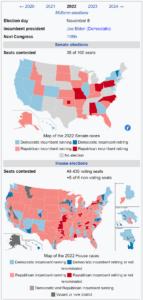

The U.S. midterm elections are important this year as they are expected to overturn the Democratic majority in both the House of Representatives and in the U.S. Senate. This would create a locked federal government, with the executive branch being led by a Democrat President and the legislative and judicial branches being dominated by Republicans and Conservatives.

Most market analysts and economists are expecting a recession of some kind in early 2023. It is likely that we can expect extreme market volatility in September and October as we go into the U.S. midterm elections on November 4th. Add to that the war between Russia and Ukraine and the potential growth of NATO and the European Union to include Finland and Sweden, which might further aggravate the situation with Russia. We continue to have the conditions for the perfect storm. Most likely, Russia will not retaliate in a military fashion, but it is highly likely that Russia will shut off oil and natural gas to Europe as it enters the winter season.

This would certainly drive-up oil and natural gas prices to new all-time highs and would have the effect of pushing the world economy into a recession. We saw this when the Federal Reserve Bank was practically bailing out the stock market via quantitative easing and keeping low-interest rates for almost 13 years. That kind of certainty created a significant amount of complacency which is now over.

For traders and investors, it is important to prepare for these potential eventualities. Markets are forward-looking and they have already started to account for an interest rate hike from every Fed meeting for quite some time. The Federal Reserve has so much catching up to do that it might take a year or two of 50 or 75 basis point hikes to get inflation under control.

The Strength of the U.S. Dollar & Understanding its Stock Market Correlation

Any time a Central Bank starts to raise interest rates, the country’s currency becomes more attractive than other countries’ currencies. When the Federal Reserve Bank raises interest rates and pays more interest to those who hold dollars, it starts to foster U.S. dollar strength. Note: the U.S. dollar has an advantage over all other currencies as it is the most widely held reserve currency in the world. It is also the currency that trades most of the world’s commodities. Oil is now being traded in Rubles rather than in U.S. dollars or Euros.

Strength in the USD is generally bad for the U.S. stock market because stocks are denominated in U.S. dollars. The value of companies generally stays the same while the value of the USD increases in value. This means stocks have to go down in order to maintain their current value. Also, many U.S. & international companies earn their income in other currencies other than the USD yet their value as listed on the stock exchange is denominated in dollars. This then leads these companies’ value to go down as the USD goes up.

What Can We Expect in the Near Future?

We would forecast long-term strength of the U.S. dollar. Furthermore, a locked federal government will lead to much more physical discipline as Conservatives and Republicans will block some of the large debt creating legislation that previously passed through Congress. These two factors combine to make long-term strength of the U.S. dollar a real possibility. Strength in the USD is often not good for gold and silver. It is likely that these commodities which have fared well lately may not do so well in the near future. This is only if there aren’t other major world events to create uncertainty for the USD. In the event of a black swan event, such as an invasion of Taiwan by China, we would see gold and silver rally back to the upside and potentially even break out in the highs.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More