Bullish and Bearish Reversal Bars and Outside Bar Candles

In our previous lesson, we discussed the benefits of taking a trade off of a narrow range bar and we learned about traders’ risk to reward ratios. Now, let us look at bullish and bearish reversal bars and learn about some of the nuances of wide range reversal patterns.

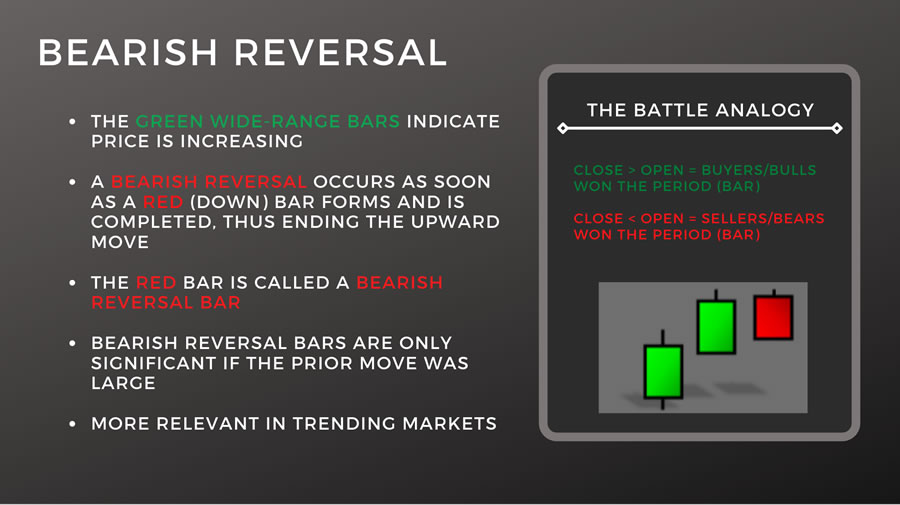

Bullish and bearish reversal bars are like a change in polarity for short term trend direction. Think of each red down bar as being a battle won by sellers. In the case of the bullish reversal, bar one is a wide range red bar down, which indicates that sellers are in control of the stock. Then, another wide range bar down shows that sellers are still in control of the stock. Finally, on the next bar buyers come back in and close the bar to the upside, which causes the candle to be colored green; this is a bullish reversal bar. It indicates that buyers have resumed control of the short term trend. Bullish reversal bars can be combined with hammers and shooting stars, narrow range bars and other technical candlestick formations. For instance, you can have a green bullish reversal hammer in the context of a buy setup.

The bearish reversal bar is the exact opposite of the bullish reversal bar. The bearish reversal bar has a strong wide range bar showing that buyers are in control of the stock’s short term trend. There is then another green up bar showing that buyers are still in control. Finally, the sellers come back in and close the next bar down, making the bearish reversal bar. Please note that it is best to have at least two strong green up bars preceding the bearish reversal bar, indicating that you have a strong trend to the upside making the bearish reversal have more impact.

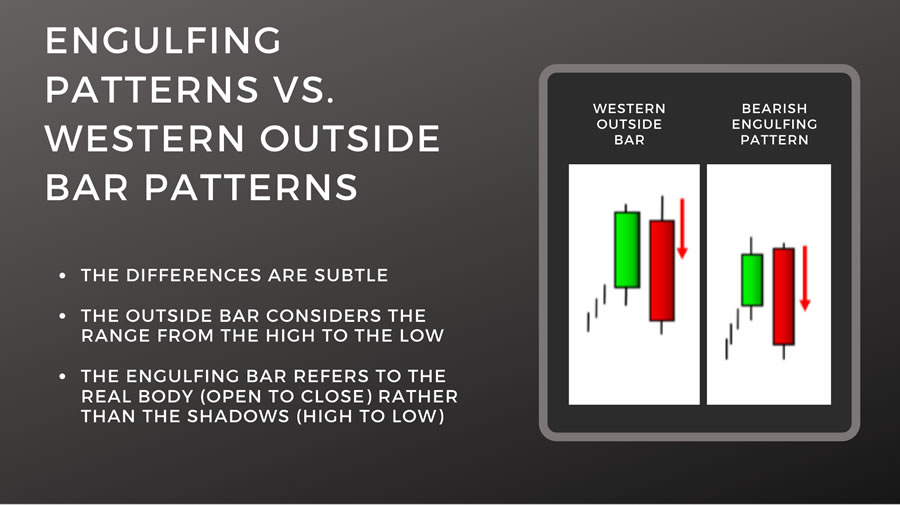

Engulfing Patterns vs. Western Outside Bar Patterns

Let us now cover the Western outside bar pattern. There must be a very wide range green up bar indicating that you have lots of traders getting long. The next bar needs to have a range that exceeds the range of bar one. It literally needs to break the resistance of bar one and the support of bar one to be a Western outside bar reversal pattern.

Now, let’s look at the bearish engulfing bar pattern. Bar one needs to be a wide green bar to the outside indicating that lots of buyers have gone long. It must have a real body that exceeds the range of the real body of the candle from bar one. Meaning that the close needs to be below the close of bar one and the open of bar two needs to be above the open of bar one.

The main differentiating factor between the Western outside bar pattern and the bearish engulfing bar pattern is that the outside bar pattern puts the emphasis on the total true range of bar two, which must exceed the total true range of bar one. Whereas the bearish engulfing bar puts the emphasis on just the range between the open and close, meaning just the body of bar two must exceed the range of the body of bar one.

Trade well.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More