In our previous blog post, we discussed the differences between global and local news events. Global events affect the entire market while local events only affect a specific stock or sector. In this post, we are going to go into details about the specific news events and how they relate to your trading.

All of the news events that you will be reading about can be planned for, meaning you know the date and time that you should be expecting them in advance. Therefore, you can plan your trades around these events, or prepare to hedge your investments if you expect volatility.

The Nonfarm Payroll Number is considered one of the two big global news events that affect the entire markets. The second being the Federal Reserve interest rate decision. These two big news events do not affect just the equity markets, but all markets.

Nonfarm Payrolls

Nonfarm payrolls are released at 8:30 AM ET on Friday’s so they can be felt in the pre-market futures. They will often gap the market in one direction or the other. The most important thing to remember about nonfarm payrolls is that the market will be muted up into the news release (1 or 2 days before) and then be volatile afterwards.

Federal Reserve Interest Rates Decision

Unlike the nonfarm payroll number, the Fed market decision is released during the market day; generally at 2:15PM ET on a Wednesday. The Federal Open Market Committee (FOMC), has dramatic effects on the equities and options markets, but will affect all markets just like nonfarm payrolls. The markets are often muted the day before and the day of the FOMC decision. Once the decision is released, there may be a small fake out. A fake out is often a move in the wrong direction, followed by a bigger move in the direction that will have lasting follow-through. Many times, the FOMC decision will reverse the day after the news is released. So if the decision is made on a Wednesday, be careful on Thursday as the big move from Wednesday has the potential to reverse.

The prudent trader is advised to expect volatility when trading around FOMC decisions. Let’s consider why interest rates are so important to the stock market. The Federal Reserve Bank is always concerned about the rate of inflation as interest rates must keep up with high inflation. If inflation is increasing rapidly, then traders and investors should expect that interest rates will follow suit.

How do we measure the rate of inflation?

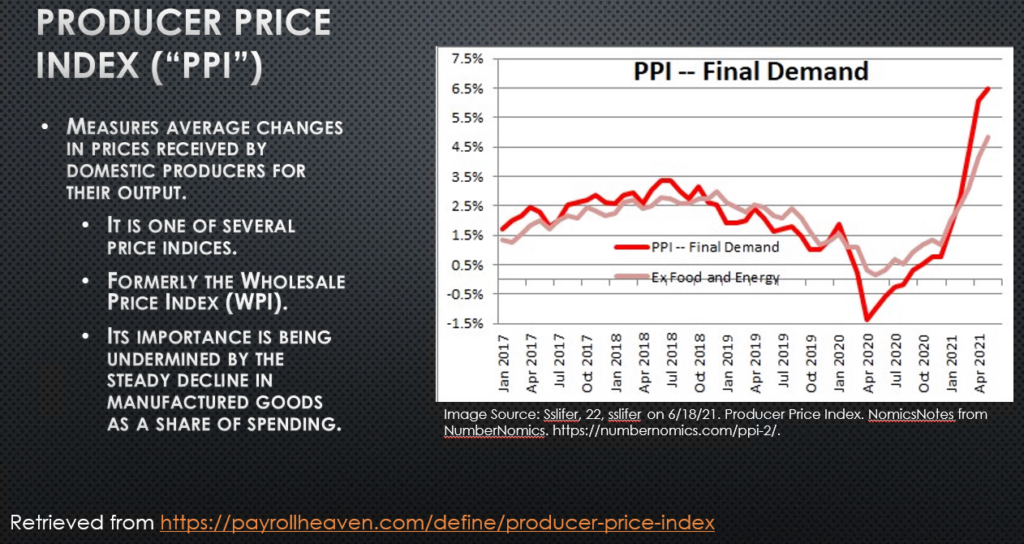

Measuring the rate of inflation can be done with indicators such as “The Producer Price Index”(PPI) and “The Consumer Price Index” (CPI) which, when announced, are considered global news events. They affect most stock and markets but are closely watched because they help measure inflation and can help gauge possible interest rate changes.

The Producer Price Index

The PPI used to be known as the Wholesale Price Index or WPI. It helps gauge the cost of goods that are produced and sold to consumers. In recent months, pandemic supply chain interruptions as well as the cost of resources transport and key materials have increased sharply.This can be seen in the chart below. The cost of goods being sold has risen so producers will have to pass those costs to consumers by raising prices, causing inflation.

The Consumer Price Index

The CPI is a basket of goods broken into eight categories that a common consumer would purchase. This index is a precursor index used to gauge inflation.

The logic behind all of this is as follows: if consumer prices are rising, inflation is rising, therefore, you can expect interest rates to be rising in the near future.

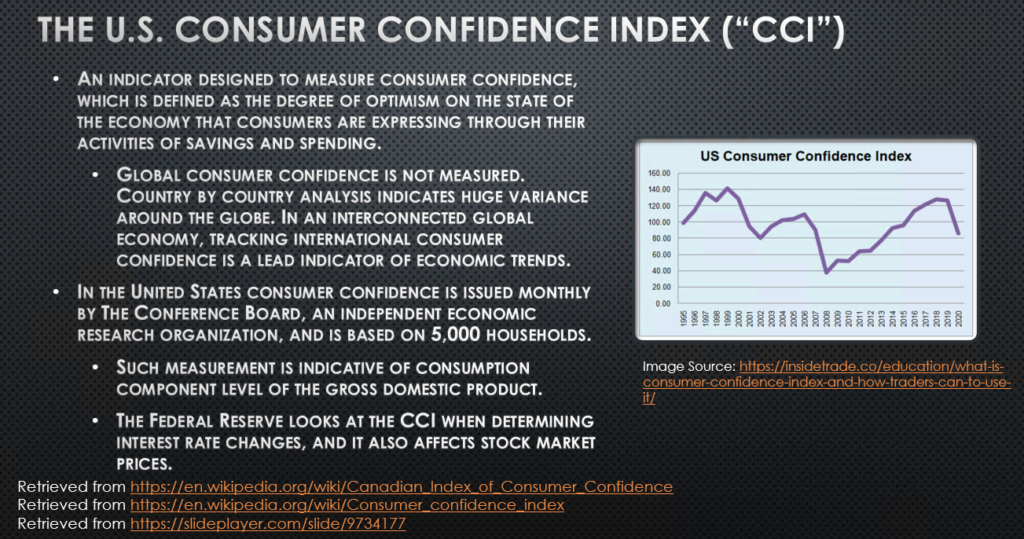

The U.S. Consumer Confidence Index

This is calculated by a nonprofit organization out of New York called the Conference Board.

The U.S. economy has rapidly become consumer focused. Measuring the strength of consumer confidence is important in gauging their future spending habits. If consumer demand starts to fall off, then that will have a negative effect on inflation. If consumers are confident in buying and consuming more goods, then that could potentially drive inflation higher if there are not enough goods available to meet that increase in demand.

At the current time, we have a situation where we see rapidly increasing demand in the United States due to the ending of pandemic restrictions. At the same time, we see the pandemic having caused supply chain problems that have reduced the amount of products, goods, and services available for those consumers to buy. This is why we are currently experiencing an increase in inflation. Will this be just a short term problem or will it persist on a longer-term basis? So far, the Fed and the U.S. Treasury have been dealing with this increase in inflation as if it is just a short term or transitory problem related to supply chain interruptions during the pandemic. This is coupled with an increase in demand as people start to emerge from lockdowns and winter around the country.

Crude Oil Inventory Number & Natural Gas Inventories

The crude oil inventory number is a local or sector specific news event. If oil prices get high enough, it can sometimes affect the entire market. As a trader, you may be looking for a trade on a Wednesday morning. A great Wednesday morning trade can usually be found by trading oil into and out of its 10:30 AM ET inventory number. This is a local or sector specific news event. It will only affect the oil sector, unless oil is approaching $100 a barrel. In this case, it will start to affect the entire market and become a global news event.

Natural gas is generally less important than oil and distillate inventories, but it works pretty much the same way. If you’re looking for a trade on a Thursday morning you can trade natural gas stocks as you know you have a volatility event coming at 10:30 AM ET.

We hope you found these descriptions of important news events helpful. Trade well and put them to good use.

Written by Michael DiGioia, Director of Institutional Sales

Mike is available for One-on-One Coaching. Learn More