Before we jump into this lesson, we must first stress that trend direction is way more important than the type of pattern that you use to enter that trend. Professional traders also must be able to make money in up, down and sideways markets. That means they must be able to effectively short stocks so that they can take advantage of downside movement. In fact, most traders like going short as their rewards are usually bigger and quicker when they come. With all that being said, let us now jump into learning about the 1-2-3 continuation short, which is a very good low risk entry into downside movement.

123 Continuation Short

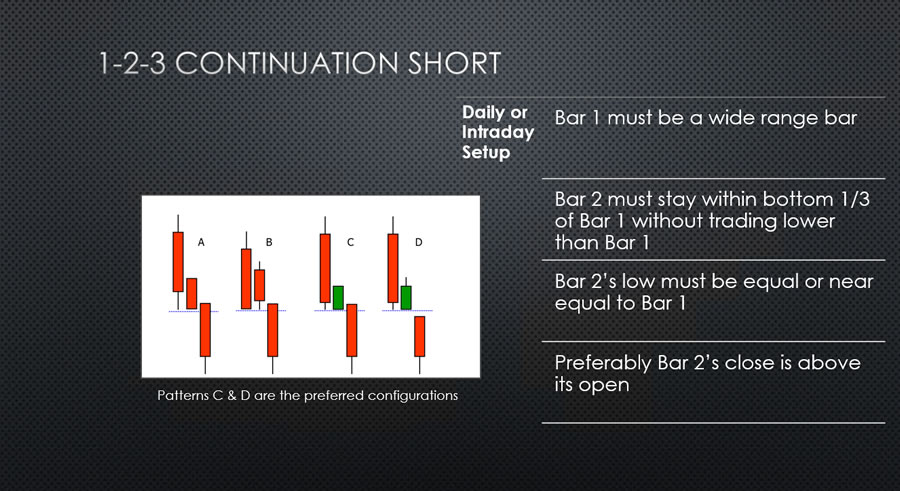

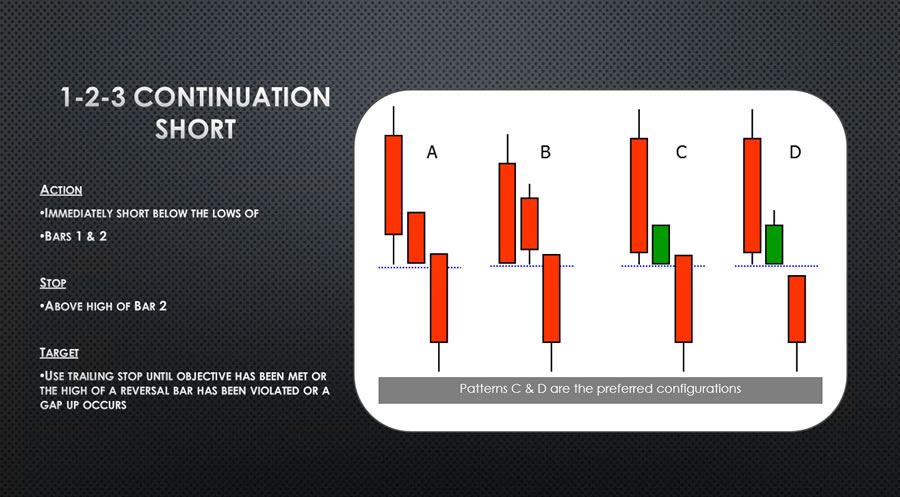

First, this pattern can be used on either a daily basis for a swing trading entry, or it can be used on any of the major intraday trading time frames for a low risk, technical day trading entry. The best intraday time frames for this set-up are the 5-minute or 15-minute, generally; as you will use the 30-minute or 60-minute intraday chart to meet the trend requirement. Remember, trend direction is the first and most important consideration. Bar one must be a wide range bar in the same direction as the prior trend. Bar two must stay in the top ⅓ of bar one. Preferably, bar two closes above it’s open, making bar two a green bar which sets up for a low risk entry.

The action is to sell short when price breaks below the low established by bar one in bar two. Your stop is above the resistance level established by the high of bar two, making your risk on this trade very small, as bar two is a narrow range bar. Your target should be a point just above a prior support point from the left of your chart. Otherwise you should use a trailing stop until your profit goal has been met. If you’re using this setup on a daily chart, you should take your profits on a big gap down or when a daily reversal bar is formed.

The best thing about the 1-2-3 continuation setup is that they occur often and they are really low risk as they are based off of an hour range bar, which means that your stop is really close by. The power of the setup comes from joining an already powerful directional trending move. They provide low risk entries into a move that has strong momentum, in this case strong momentum to the downside. If you anticipate your entry to get into the short on the narrow range green bar up on bar two, you can also get in without having to worry about having an uptick as you can sell short by offering into the move.

We hope you find these lessons helpful. Trade well.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More