The month of August often comes in like a lion and goes out like a lamb. Early in the month, markets are fueled by second-quarter earnings results, but momentum typically fades into the late-summer doldrums. In fact, the last two weeks of August are historically the second-lightest trading volume period of the year—surpassed only by the days between Christmas and New Year’s. (See our blog post: The Most Bullish and Bearish Months of the Year)

This year, however, markets hardly skipped a beat through the summer. A few factors may explain why:

- “Sell in May” didn’t happen. The old adage of “Sell in May and go away” didn’t materialize this year. Instead, stocks stayed resilient throughout the summer.

- Political and policy shifts. We are in the first year of a new presidential administration, and U.S. trade policy has undergone a multigenerational shift. These factors may have changed the usual market rhythm.

- Digital markets and constant access. Unlike decades past—when summer travel meant less participation from trading desks—investors now remain active year-round thanks to digital platforms and mobile access.

Most likely, it’s a combination of these forces that muted the seasonal slowdown this year.

Technical Perspective

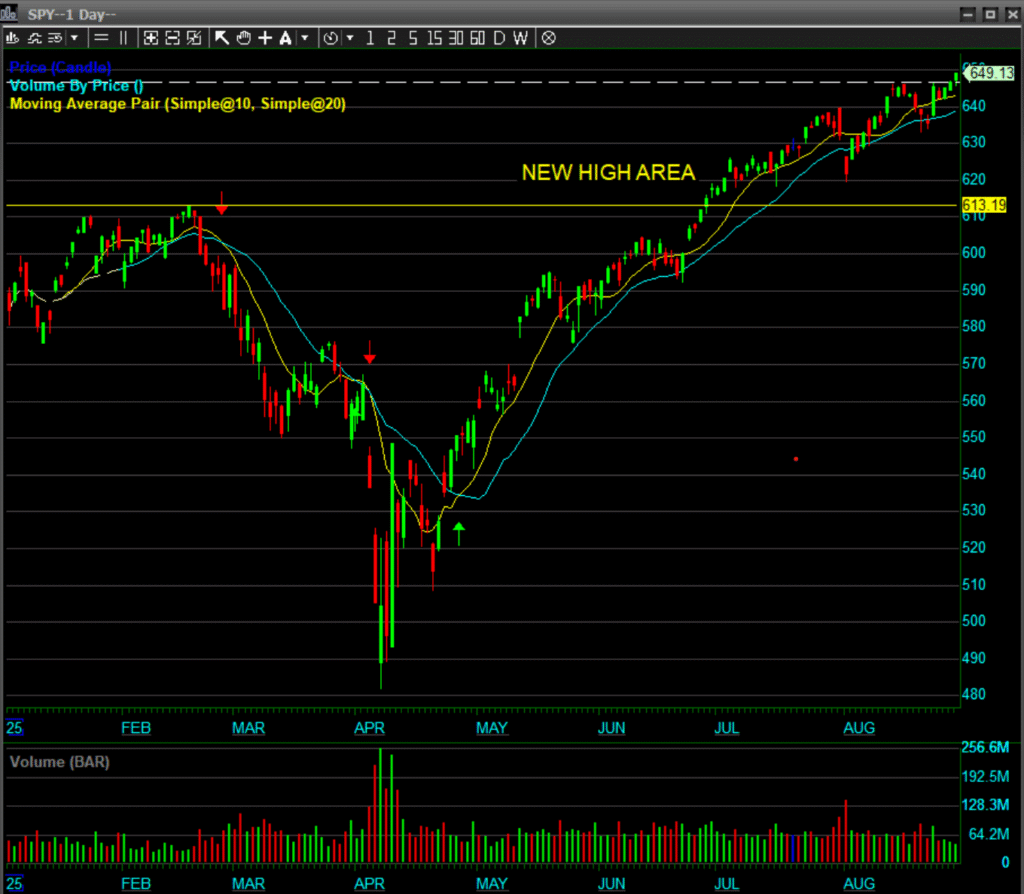

From a technical standpoint, all three major indices remain in firm uptrends:

- S&P 100 (OEX): Recently broke out to all-time highs and continues to show leadership.

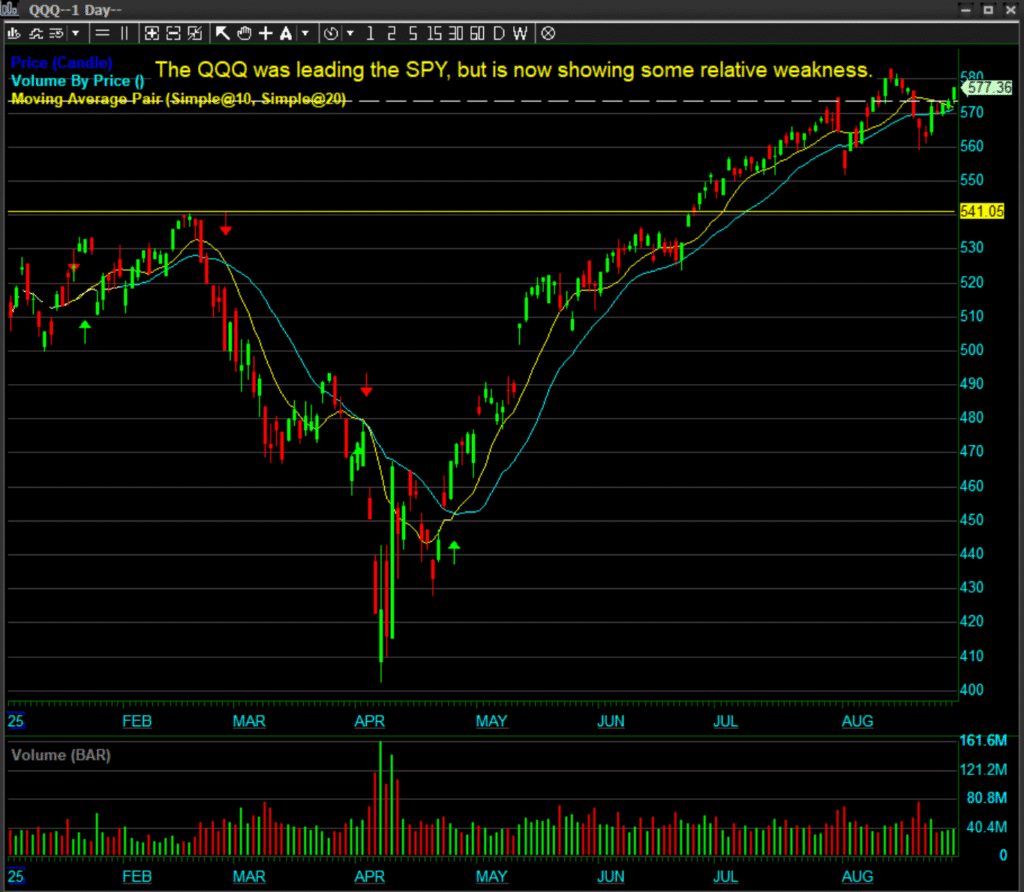

- Nasdaq 100 (NDX): Near record highs as well, though not as strong as the S&P 100 at the moment. It’s worth noting that the Nasdaq has led markets since the pandemic, so this rotation of leadership to the S&P is healthy and constructive.

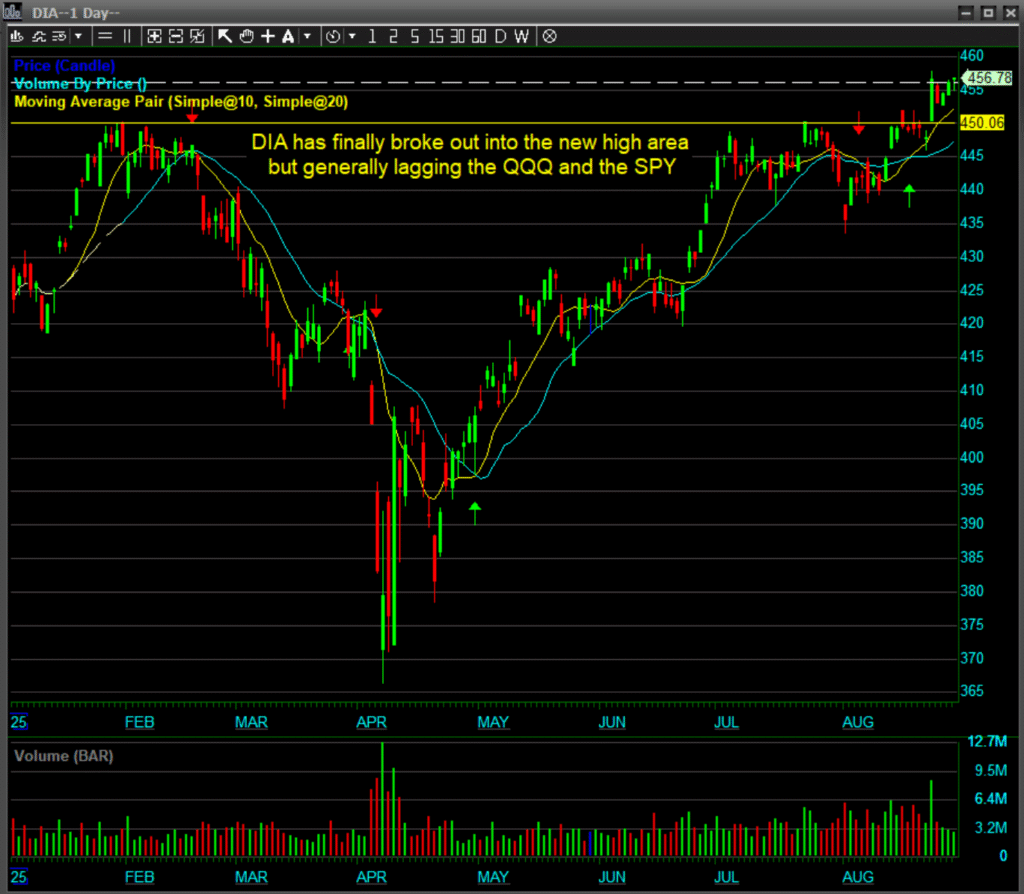

- Dow Jones Industrial Average: Also at new highs and firmly trending upward.

In short, the technical picture across the board remains bullish.

Fundamental Perspective

Beneath the surface, however, a few red flags remain:

- Rising inflation and higher producer prices, partly due to new tariffs.

- Reports of layoffs across sectors.

- A softening housing market, with prices beginning to decline in some key regions after years of steady gains.

These are not definitive signs of economic weakness but are potential headwinds that markets may need to navigate as the economy adjusts to structural changes.

Looking Ahead: September Seasonality

As highlighted in our seasonality analysis, September has historically been the weakest month of the year for the last two decades. With markets at or near record highs, caution is warranted. A short-term pullback or consolidation here would actually be healthy, allowing markets to digest gains before the next leg higher.

Bottom Line:

Markets remain technically strong, but seasonality suggests vigilance heading into September. Traders and investors alike should stay nimble, manage risk, and remember: even in uptrends, healthy corrections are part of the process.

Trade well!

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More