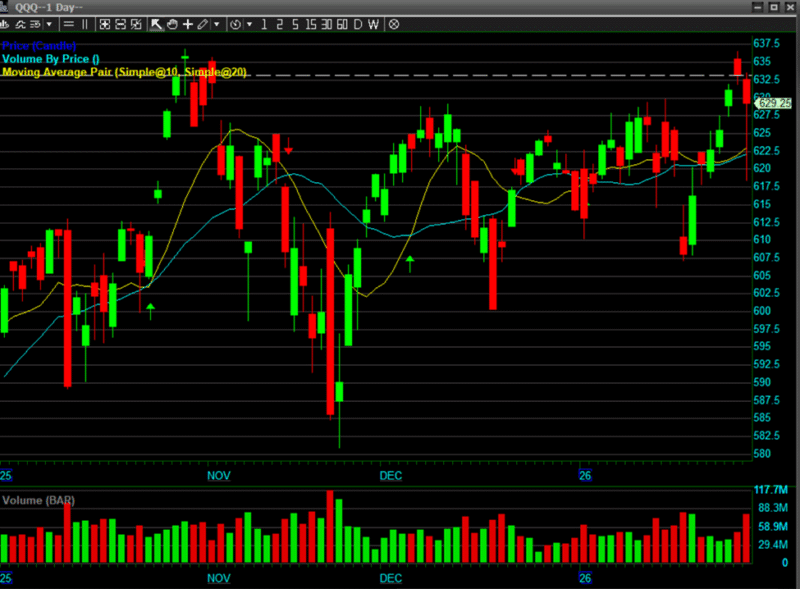

January 2026 was largely range-bound for U.S. equity markets, but it was absolutely packed with news.

To recap, the month began with the stunning capture of Venezuelan President Nicolás Maduro. One interesting detail is that a Chinese delegation was in Venezuela at the time of the capture, reportedly looking to negotiate some form of oil deal with the president, who is now being held for trial in federal prison in Brooklyn, New York. Initially, markets reacted positively to these dramatic police actions. However, that reaction quickly faded after President Trump announced renewed interest in purchasing Greenland from Denmark.

This saber-rattling was later reversed when President Trump stated that no military action would be taken against Greenland during his address at the World Economic Forum in Davos, Switzerland. What President Trump was able to achieve, however, was an increased U.S. military presence on the island nation of Greenland. The United States also secured key contracts and port access that it claimed were necessary to maintain Arctic security for the U.S. and the Western Hemisphere.

What was not widely discussed by mainstream media is that this episode highlights the continued erosion of the multilateral international system that has largely defined global relations since World War II. In the past, countries like the United States would seek to build coalitions to support their goals. In this instance, the U.S. appeared willing to risk elements of the multilateral NATO alliance in exchange for strategic control of an island nation such as Greenland. While the multilateral system has not been completely abandoned, there are increasing signs that it is coming apart at the seams.

The Shiny, Yet Best Performing Assets

This brings me to what is likely the best-performing asset class of 2026—one we have been highlighting in this newsletter for several years: gold and silver. Both metals have been on an absolute tear. Silver has finally reached $100 an ounce, representing an increase of more than 250% over the past year. Gold has also reached all-time highs.

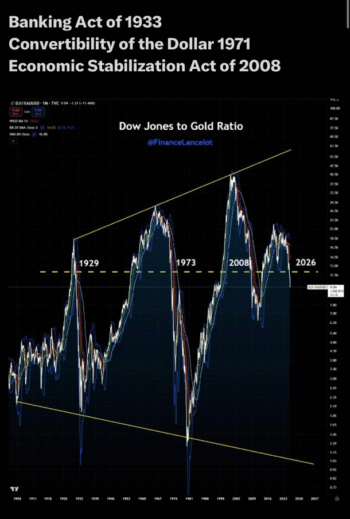

This move has been largely driven by U.S. dollar weakness, which has incidentally also helped lift equity markets. However, as you can see in the accompanying chart, this dynamic has historically not been a positive long-term indicator for financial markets.

Gold typically rises as a hedge against U.S. dollar weakness, and in 2025 and 2026 the dollar has lost significant ground as the world’s reserve currency. At the beginning of 2025, the U.S. dollar accounted for roughly 60% of global currency reserves; today, that figure is closer to 40%. This shift has benefited gold and silver tremendously. As foreign countries diversify away from dollars, they have increased purchases of gold and silver to strengthen their reserve positions.

Rising global energy and power demands have also benefited silver, which is an excellent conductor with significant industrial use. For this reason, silver generally outperforms gold during commodity bull markets—but it also tends to under-perform gold during commodity bear markets.

Stock Prices vs. The Price of Gold

Image source: FinanceLancelot

Image source: FinanceLancelotMore concerning is the fact that U.S. equity markets, when denominated in gold, are showing signs of entering a new bear market. Stocks appear to be making new highs only because they are denominated in dollars; when priced in gold, U.S. equities are not reaching new highs, as illustrated in the chart below.

Digital assets have also underperformed hard commodities such as gold and silver, as well as equity markets, since the last quarter of 2025. After strong interest and price movement in the first half of 2025, the digital asset space—Bitcoin often being referred to as “digital gold”—has largely lost its luster.

Looking ahead, we face a growing wall of worry: another potential federal government shutdown looms, and geopolitical risk appears to be the new normal, even as markets have largely chosen to ignore it so far.

In conclusion, caution is warranted. It is prudent to take profits in asset classes like gold and silver, which have posted tremendous gains over the past several months. When taking profits, it is generally best to take partial profits rather than fully exiting a position. This approach allows you to lock in gains, reduce risk, and still maintain exposure in case the asset continues to run.

Prudent traders and investors take partial profits and always ring-fence their gains. On that note, trade cautiously—until next time.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More