As the stock market once again sits at new highs heading into November, we have to ask ourselves: is this rally for real, or is it, to some degree, just optics? You might say, “How can a rally not be real?” Well, let’s first look at how markets are denominated.

Stocks are priced in U.S. dollars, and this year the dollar has had its worst performance since the 1970s. Why is this important? When the U.S. dollar declines—as it has by roughly 9% this year—stocks invariably appear to rise, because they are denominated in dollars. However, the businesses that make up these indexes don’t just earn U.S. dollars. Some generate revenue in foreign currencies, while others hold substantial dollar-denominated assets. When the dollar weakens, these assets naturally rise in value when converted back into dollars, pushing stock prices higher even if the underlying fundamentals haven’t changed.

The Gold Standard

Famous banker J.P. Morgan once stated, “The only real currency is gold. Everything else is just credit.” And to a certain degree, he was correct. Currencies are backed by the full faith and credit of the governments that issue them. The U.S. dollar, which has weakened over the past year, is ultimately a credit instrument guaranteed by the full faith and credit of the United States government.

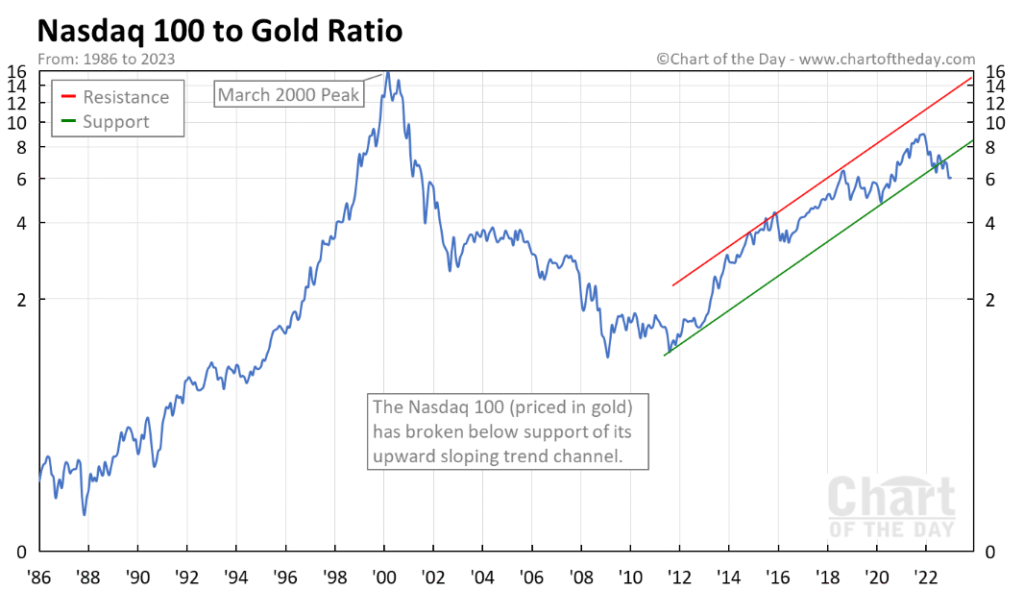

A better gauge of the stock market’s true value would be to view it denominated in gold or silver, since both metals have rallied sharply as the dollar has weakened. Part of the reason for the dollar’s weakness is that several foreign countries—including Russia, China, India, and Brazil, to name a few—have sold portions of their U.S. dollar reserves and purchased gold and silver instead. This shift has weakened the dollar, strengthened the metals, and indirectly supported U.S. equity prices, since the markets are priced in dollars.

A better gauge of the stock market’s true value would be to view it denominated in gold or silver, since both metals have rallied sharply as the dollar has weakened. Part of the reason for the dollar’s weakness is that several foreign countries—including Russia, China, India, and Brazil, to name a few—have sold portions of their U.S. dollar reserves and purchased gold and silver instead. This shift has weakened the dollar, strengthened the metals, and indirectly supported U.S. equity prices, since the markets are priced in dollars.

Because most major currencies are also influenced by the U.S. dollar, as the dollar declines, many of the assets on corporate balance sheets—such as real estate and commodities—increase in value in nominal terms.

Don’t Expect Another Cut

Turning to the Federal Reserve, this past week the Fed reduced interest rates by a quarter of a percentage point, but Chairman Jerome Powell indicated that the expected rate cut in December may not be as likely. This hesitation is partly due to continued dollar weakness and rising inflation. Additionally, there has been a noticeable spike in layoffs in recent months, while hiring has slowed considerably. These warning signs are key indicators the Federal Reserve considers when deciding whether to continue cutting rates.

Cracks in the Foundation

From a technical perspective, we often say that “the trend is your friend”—and that remains true, as trends tend to persist much longer and move much farther than most expect. Another well-known market adage is that “70% of the move happens in the last 30% of the time.” In other words, markets can become extremely parabolic before finally exhausting themselves. We’ve seen this recently, as stock indexes continue to set new highs despite growing economic warning signs. The market continues to climb even as the underlying economy begins to show cracks.

Before we wrap up, let’s identify what some of those cracks might be:

- Inflation has begun to creep higher once again.

- Layoffs have increased, while new hiring has slowed.

- The U.S. dollar remains extremely weak—the very foundation of market valuation.

- The U.S. consumer appears to be running out of credit, after years of debt-fueled spending that has driven much of the market’s momentum.

These four warning signs don’t necessarily mean that a correction is imminent. As mentioned earlier, trends can continue long after the cracks begin to appear. However, prudent investors should start to take a more cautious stance toward the stock market.

So as we move toward the end of the year, trade carefully and stay alert. No matter how strong consumer demand appears during the holiday season, it may not be enough to meet analysts’ expectations after such a prolonged rally.

Written by Michael DiGioia, Director of Education

Mike is available for One-on-One Coaching. Learn More